财富五年大复盘:疫情、战争如何改写房地产格局?

◆ ◆ ◆ ◆

从“危机”到“转机”:房地产成为乱世避风港

From Crisis to Opportunity: Real Estate as a Sanctuary Amid Global Chaos

◆ ◆ ◆ ◆

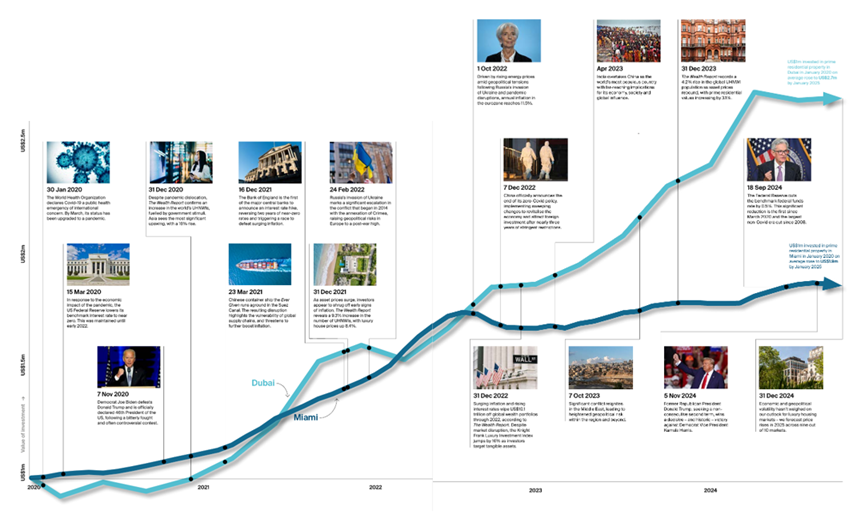

从2020年初的新冠疫情,到2022年俄乌冲突爆发,再到2024年美联储鹰派政策反转和特朗普重返白宫——过去五年,世界仿佛按下了“剧本开挂”键。

From the onset of the COVID-19 pandemic in 2020, to the eruption of the Russia-Ukraine war in 2022, and the Federal Reserve’s hawkish reversal and Trump’s dramatic political comeback in 2024 — the world, it seems, has been operating on an accelerated, almost surreal script.

宏观不确定性成为常态,国际局势剧烈波动,资产市场震荡不断。但在一片混沌之中,有一个领域却悄然穿越周期、走出了截然不同的走势:高端房地产。

Macroeconomic unpredictability has become the norm. Geopolitical tremors shake the foundations of global order. Financial markets sway under the weight of uncertainty. And yet, in the eye of this storm, one sector has quietly charted its own course — luxury real estate.

没错,全球富人用脚投票,用资产说话。他们在动荡之中不断寻找“财富避风港”,而房地产,尤其是顶级住宅市场,正在成为他们重新押注世界格局的主战场。

Indeed, the world’s wealthiest are casting their votes with assets, not words. In an era of upheaval, they seek safe havens — and real estate, especially in the high-end residential realm, is becoming their preferred front line for hedging against global disarray.

以迪拜和迈阿密为例,根据《财富报告2025》数据显示,2020年1月投入100万美元购买的豪宅,到2025年已经分别上涨至270万美元和190万美元。也就是说,在仅仅五年时间里,资产翻了近两倍——这并非普通投资者的幻想,而是正在发生的现实。

Take Dubai and Miami, for instance. According to the Wealth Report 2025, a $1 million luxury property purchased in January 2020 would now be worth around $2.7 million in Dubai and $1.9 million in Miami. That’s not an investment daydream — it’s a real, measurable shift in value over just five years.

你可能会疑问:在全球利率高企、金融动荡的背景下,为什么“砖头瓦块”反而更吃香?

In a world gripped by inflation and rising rates, why are bricks and mortar drawing such intense demand?

这其实透露出一个本质:在“去全球化”和“高波动性”的时代,有形资产、稳定收益、抗通胀的投资标的越来越稀缺。房地产天然具备这三重属性,再加上它能落地、能移民、能避税,对于高净值人群来说,就是一张“跨国通行证”。

It points to a deeper trend: in an era of de-globalization and volatility, tangible, income-generating, and inflation-resistant assets are in increasingly short supply. Real estate embodies all three traits. Factor in its advantages in residency, tax planning, and legal ownership, and it becomes a powerful transnational asset for the ultra-wealthy.

更重要的是,危机之下人们对“安全感”的理解变了。比起流动性,他们更看重控制权;比起年化收益率,他们更关心能否稳定持有、传承、抵御政策变化。这些变化,正在深刻重塑财富流向的轨迹。

Perhaps most tellingly, our definition of “security” has changed. Liquidity no longer trumps all — control does. Annual returns matter less than holding power, legacy value, and resilience against policy swings. These shifting values are reshaping the very architecture of wealth around the world.

◆ ◆ ◆ ◆

迪拜和迈阿密逆势飞升:是谁在疯狂买入?

Dubai and Miami Break Away:

Who’s Fueling the Luxury Real Estate Frenzy?

◆ ◆ ◆ ◆

一边是全球房地产市场在高利率下集体熄火,一边却是迪拜和迈阿密的房价在飞奔,宛如两道逆势的“财富黑洞”。

While rising interest rates have cooled housing markets across the globe, two cities are racing in the opposite direction — Dubai and Miami. These aren't just anomalies; they’re turning into gravitational centers of capital — “wealth black holes” pulling in money as the world’s rich shift their strategies.

这不是偶然,而是富人群体主动“迁移资产”的结果。

What’s driving this phenomenon? It’s not luck. It’s intent.

我们先看迪拜。这个中东城市原本以“油气金融”为标签,但在过去几年里,它迅速变成了全球富豪争相落户的热土。一方面是阿联酋政府持续推出黄金签证、免税政策、外资持有宽松化等“亲资本”举措,另一方面则是迪拜本身拥有“政治稳定+自由度高+生活成本相对合理”的独特吸引力。

Dubai, once synonymous with oil and finance, has swiftly repositioned itself as a magnet for global billionaires. The UAE’s government has played a pivotal role, launching investor-friendly reforms: golden visas, tax incentives, and relaxed property rules for foreigners. Combine that with political stability, personal freedoms, and relatively moderate living costs, and the appeal becomes undeniable.

在2023年,迪拜成为全球超高净值人群(UHNWI)资产迁移的第一目的地。据《财富报告》披露,亚洲、俄罗斯、英国等多个地区的富豪在大批量购入迪拜的顶级公寓和别墅,甚至部分豪宅项目在预售期就已售罄。

By 2023, Dubai topped the charts as the number one destination for asset migration among ultra-high-net-worth individuals. According to the Wealth Report, billionaires from Asia, Russia, and the UK flooded the market — some high-end developments sold out entirely during pre-sales.

迈阿密的爆发也极具代表性。这个原本只是“度假天堂”的海滨城市,在疫情之后迅速完成了“财富重构”。它吸引的不仅是美国本土的硅谷、新泽西、纽约富人“南下置业”,更有大量来自南美、中东甚至欧洲的家族办公室纷纷落户。低税负、阳光气候、不断崛起的金融科技生态圈,使得迈阿密逐渐从“边角城市”跃升为全球资产避险港。

Miami’s transformation is equally striking. Once a playground for vacationers, the city has rapidly morphed into a hub for wealth restructuring. It’s not just Americans from Silicon Valley or New York moving in. Family offices from South America, the Middle East, and Europe are setting up shop. With no state income tax, a favorable climate, and a burgeoning fintech scene, Miami has emerged as a serious contender in the global safe-haven sweepstakes.

这些城市的共同特征是什么?三个关键词:自由流动、身份通道、资产保护。

What ties these cities together? Three words: mobility, identity, and protection.

在今天这个“地缘不确定性溢价”不断扩大的世界里,买房已经不仅仅是居住功能,更是一种“战略资产配置”。富人们用热钱涌入的背后,是对制度红利、政策风险和资本自由度的极致判断。

In today’s age of geopolitical anxiety, buying property is no longer just about comfort — it’s about survival. It’s a chess move on the global board. Behind the flood of investment lies a clear, strategic calculus: legal frameworks, freedom of capital, and access to alternative residency.

所以,不是迪拜和迈阿密有多特别,而是它们“刚好满足了时代最焦虑的一群人”的所有需求。

So no — Dubai and Miami aren’t outliers by accident. They’ve simply become the perfect answer to the question keeping the world’s wealthiest up at night.

◆ ◆ ◆ ◆

疫情时代的资产逻辑变化:从流动性到安全性

From Liquidity to Longevity:

How the Pandemic Rewired the Wealth Mindset

◆ ◆ ◆ ◆

2020年之前,富人的投资逻辑里,“流动性”几乎是第一信仰。资产配置追求的是“快进快出”:股市、科技股、加密币、创投基金,最好一夜暴富,哪怕波动剧烈也无所谓。

Before 2020, liquidity reigned supreme in the minds of the rich. Speed was everything — stock markets, tech booms, crypto spikes, venture capital moonshots. The dream? Get in fast, get out richer. Volatility wasn’t a bug — it was the feature.

但疫情来了,战争升级,全球供应链塌方,贸易保护主义抬头,现实教会所有人一个词——“生存优先级”。

Then came a cascade of crises: the pandemic, wars, crumbling supply chains, and the rise of trade protectionism. The world changed — and with it, the rules of survival.

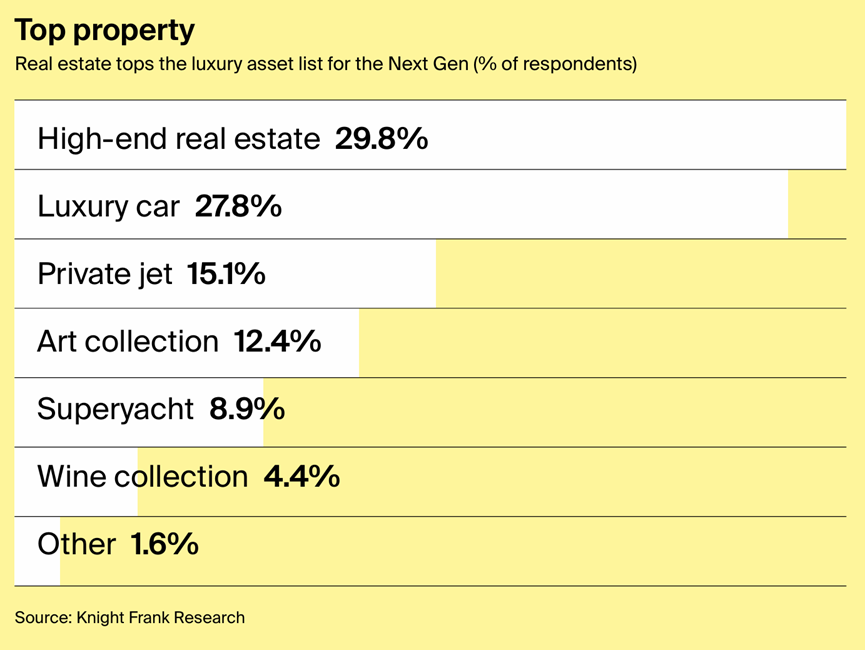

对于富人来说,这场变局彻底改写了资产选择的标准:以前是“哪里赚得多”,现在是“哪里拿得稳”。从“高频交易”转向“重仓实物”,从“估值逻辑”回归“看得见摸得着”,房地产,尤其是可控的核心城市物业,迅速成为首选。

For the ultra-wealthy, this upheaval triggered a radical shift in what it means to invest wisely. The focus moved from “where can I win big?” to “what will last through chaos?” Gone is the obsession with high-frequency gains. In its place: a deliberate turn toward real, tangible, controlled assets. Real estate — especially in prime urban zones — is now the crown jewel of this new defensive strategy.

这一趋势在《财富报告》中的数据表现得尤为明显:

◎2023年开始,全球超高净值人群对住宅和商用地产的配置比例逆势上升,占家族办公室总资产的比重突破 22.5%;

◎同时,超过 44% 的家族办公室明确表示将在未来18个月进一步加大房地产投资;

◎即便利率上行,许多家族依然选择“现金买房”,跳过杠杆,因为“安全感比收益率更重要”。

The numbers don’t lie, as detailed in the Wealth Report:

◎Since 2023, the share of real estate — both residential and commercial — in UHNW portfolios has climbed steadily, surpassing 22.5% of total family office holdings;

◎Over 44% of family offices intend to increase their property investments in the next 18 months;

◎Even in the face of rising interest rates, many buyers are skipping leverage altogether and paying in cash — because peace of mind now outweighs performance metrics.

另一个明显的转变是:富人不再关注“资产能升值多少”,而更在意“这个东西是否能穿越周期、长期持有、低被动风险”。所以我们看到他们买下整栋大厦、包下高端租赁公寓楼、投资带农场的庄园……这些资产共同特点是:稳、难抄袭、有现金流,最重要的是,抗政策波动。

And what’s changed most? It's not just the type of assets — it’s the criteria for choosing them. Forget wild appreciation curves. Today’s wealthy care about durability, transferability, and immunity from policy shocks. That’s why they're buying whole towers, entire luxury complexes, even estates with farmland. These aren’t just assets. They’re fortresses.

正如报告所说,这不是“投资转型”,而是财富保护逻辑的重建。当你不知道明天美元是否还会坚挺、银行是否稳定、政策是否朝令夕改时,拥有可控实体资产就成为“最后的保险”。这股“避险转向安全”的投资风,吹的其实不是房地产本身,而是投资心态的根本变化。

As the report concludes, this isn’t an investment trend — it’s a reinvention of what wealth protection means. When you’re unsure whether your currency, your bank, or your government will stay steady, there’s only one answer left: own something you can touch, control, and keep. This flight to safety isn’t a love affair with property — it’s a reflection of a deeper shift: from chasing returns to preserving freedom.

◆ ◆ ◆ ◆

全球房地产“拼图游戏”:哪些城市正被富人盯上

From Crisis to Opportunity: Real Estate as a Sanctuary Amid Global Chaos

◆ ◆ ◆ ◆

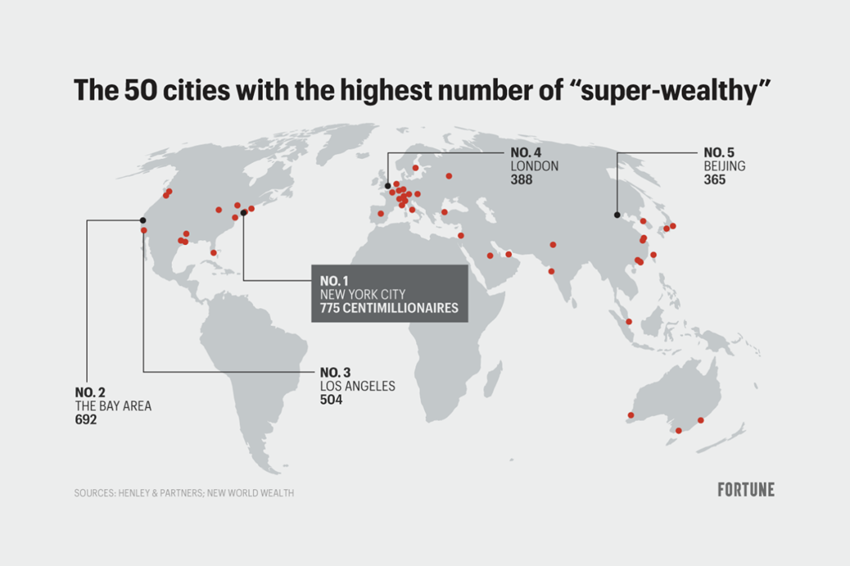

如果你打开一张世界地图,去标记那些房价逆势上涨、富人资产流入最多的城市,你会惊讶地发现:它们分散在全球,却像一块块“资产拼图”,拼出了一个新的财富迁徙网络。

Pull out a map and pinpoint the cities where property prices continue to rise — even as global markets stall. Track the flow of billionaire capital. What emerges isn’t randomness — it’s a pattern, a puzzle of privilege: a new global wealth migration map.

根据《财富报告2025》披露的数据,在过去五年中,迈阿密、迪拜、伦敦、东京、新加坡、悉尼、苏黎世、香港等城市,持续吸引大量高净值人群购房入驻,成为所谓的“富人新结点城市”。

According to the Wealth Report 2025, cities like Miami, Dubai, London, Tokyo, Singapore, Sydney, Zurich, and Hong Kong have steadily drawn in high-net-worth investors over the last five years. These aren’t just investment hot spots — they’re the new epicenters of global wealth positioning.

再往后看,《财富报告》甚至预测,像西班牙的马德里、葡萄牙的里斯本、泰国的普吉岛、南非的开普敦,也正在逐步被纳入富豪的“另类资产雷达”。

And what’s next? The report highlights rising interest in Madrid, Lisbon, Phuket, and Cape Town — emerging destinations on the radar of the ultra-wealthy looking to diversify beyond the usual suspects.

这不再只是买一套房,而是富人在全球“撒豆成兵”式的布局。他们在拼一张全球资产地图,确保无论世界风吹往哪个方向,总有一处资产在安全地带里生根发芽。

The global rich are scattering their holdings like chess masters — ensuring that no matter which way the world turns, their assets are rooted in resilience. It’s not about how much square footage you own — it’s about how many strategic coordinates you command.

而对普通投资者来说,这张拼图的走向,意味着下一个增值窗口在哪,也意味着当资本开始“移动”,谁才是最终赢家。

For ordinary investors, the takeaway is clear: watch where the capital flows — and you’ll see where the future blooms.

◆ ◆ ◆ ◆

富人用脚投票的五年,普通人该读懂什么?

When the Wealthy Vote with Their Feet:

What Should the Rest of Us Take Away?

◆ ◆ ◆ ◆

过去五年,是全球高净值人群“脚投票”的五年。他们搬家、换身份、投资、迁资产——不是为了追逐更高的年化收益率,而是为了应对一个正在变得陌生、不确定、难预测的世界。

The past five years have been a masterclass in quiet moves with massive meaning. The world’s wealthiest didn’t shout; they relocated. They didn’t debate — they moved their money. Not chasing wild returns, but searching for something far more valuable: control in a world that feels increasingly out of control.

《财富报告》给出的趋势并不只是“富人买了什么、去了哪里”这些表象,更深一层的信号是:他们已经悄悄完成了一轮财富逻辑的大迁徙。

The Wealth Report doesn’t just track who bought what and where. It uncovers a deeper shift: a silent migration in how the rich define and defend their wealth.

而普通人真正该关注的,不是“我买不起迪拜的房”,而是这些趋势能带来哪些启示?

第一,安全性正在超越收益率。如果富人都在选择更可控、更抗风险的资产,那说明当下市场的不确定性依然在加剧。我们不能再只盯着短期涨跌,更要关注资产的“穿越周期”能力。

第二,房产并未失宠,只是失去了泡沫。很多人误以为房地产已无投资价值,其实是因为他们关注的是“过去涨没涨”,而富人关注的是“未来还能不能保”。真正有价值的资产,永远稀缺。

第三,资产配置正在全球化,而不是本地内卷。你以为买房就是“刚需or投资”,但对富人来说,一套房可能意味着税务筹划、身份优化、子女教育、甚至危机时的避难所。换句话说,富人看资产,不是“这个东西值多少钱”,而是“它能为我的人生带来多少可能性”。

So what should the rest of us learn from this quiet revolution?

1. Security is the new alpha.

If billionaires are prioritizing safety over growth, maybe we should, too. In volatile times, it’s not about how high an asset can go — it’s whether it can stand tall when everything else falls.

2. Real estate isn’t over — speculation is.

The game has changed. The rich don’t care about short-term price charts — they care about long-term utility, resilience, and scarcity. The smartest players aren’t chasing hype — they’re chasing havens.

3. Geography is the new diversification.

A house isn’t just a home. For the wealthy, it’s a residency tool, a tax lever, a family safe zone. It’s an escape hatch in case the world turns — and a way to anchor freedom, not just capital. The ultimate insight? Wealth isn’t just money. It’s mobility. It’s choice. It’s the ability to act when the world shifts.

这也是这五年最大的财富启示:投资的核心不只是钱,而是自由——对生活的掌控权。我们不一定成为超级富豪,但可以做一个看懂趋势、懂得“站在时代风口前面”的普通人。当他们在重新划定“资产地图”的时候,我们也许该开始思考——自己的下一步,在哪一格。

You don’t have to be ultra-rich to understand the game. You just need to see where the board is moving — and claim your square before it’s taken.Because as the powerful redraw their maps, you get to decide: Where do you stand — and what’s your next move?