Where Are the Rich? A Revealing Map of Global Super-Wealth Migration

◆ ◆ ◆ ◆

全球财富的大迁徙,悄悄发生了什么?

The Silent Shift in Global Wealth:

What’s Really Happening Beneath the Surface?

◆ ◆ ◆ ◆

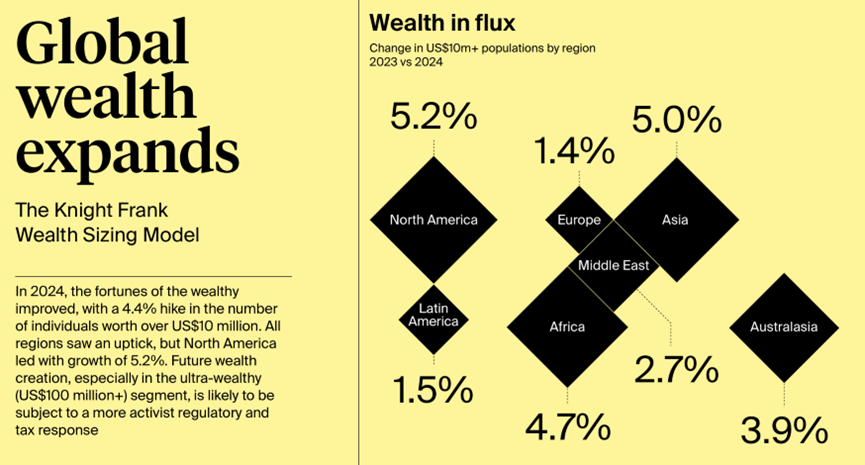

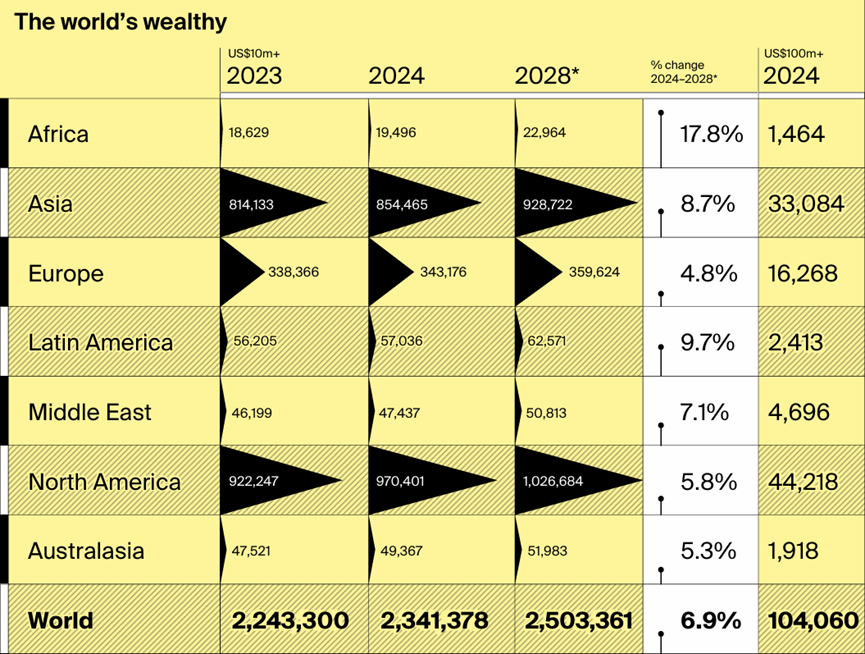

2024年,全球高净值人群数量增长了4.4%,总人数超过234万人,平均每个人身家过千万美元。这是一组你可能不太关注的数据,但它背后的财富迁徙,却正深刻影响着这个世界。

In 2024, the number of high-net-worth individuals (HNWIs) worldwide grew by 4.4%, surpassing 2.34 million people—each with an average net worth of over $10 million. It’s a statistic you might overlook, but behind these numbers is a subtle yet seismic shift reshaping the economic geography of our world.

在你还在为还房贷焦虑时,世界上有一群人正在重新安排他们的钱、身份、资产,甚至“国籍”。他们的选择,构成了一张你意想不到的“全球财富迁徙地图”。

While most people remain consumed by mortgage payments and day-to-day finances, the ultra-wealthy are quietly redrawing the lines of wealth, identity, and influence. Their choices have given rise to a new, unexpected cartography—a global wealth migration map that tells a story not of tourism, but of long-term strategy.

这场迁徙,并非简单的“有钱人换城市”,而是一种带有趋势性、结构性的“资产再布局”。而《财富报告2025》里的最新数据就像一张X光片,把全球资本流动的走向照得一清二楚。一个明显的现象是:财富正在加速“向外溢出”。

This isn’t simply about millionaires switching cities. It’s a structural, directional reallocation of capital on a global scale. The Wealth Report 2025 offers a kind of economic X-ray—one that exposes the routes through which money is flowing, and where the next centers of gravity may emerge. One thing is clear: wealth is no longer staying put—it’s dispersing outward, and fast.

疫情、通胀、战争、税改……这些宏观变量让高净值人群普遍提高了全球化资产配置的比例。换句话说,钱不再集中在“本地”,而是流向那些更能提供安全感、身份规划、子女教育和资产保护的“超级节点城市”和国家。而这种流动,正在无声地决定未来哪些国家会变得更有钱,哪些城市将成为“下一代财富中心”。

Macroeconomic shocks like pandemics, inflation, wars, and tax reforms have spurred the wealthy to diversify across borders. Money now gravitates not just toward returns, but toward jurisdictions that offer stability, elite education, asset protection, and future-proof identity options. The flow of capital, quiet as it may be, is actively redrawing the global map of influence.

这是一场没有硝烟的“财富再分配”,而数据,正是这场战役中最真实的战报。

This is a redistribution of wealth without bullets—and the data is our most revealing dispatch from the frontlines.

◆ ◆ ◆ ◆

谁才是“全球最能赚钱的国家”?

Which Country Is Truly Winning the Wealth Game?

◆ ◆ ◆ ◆

提到全球最富的地方,很多人第一反应是瑞士银行、阿联酋土豪,或者硅谷科技大佬。但如果你翻开《财富报告2025》的那张数据表,最直观的答案其实只有一个:美国。

Mention global wealth, and people picture Swiss vaults, Gulf oil dynasties, or Silicon Valley billionaires. But when you dig into the hard data of The Wealth Report 2025, one answer stands head and shoulders above the rest: the United States.

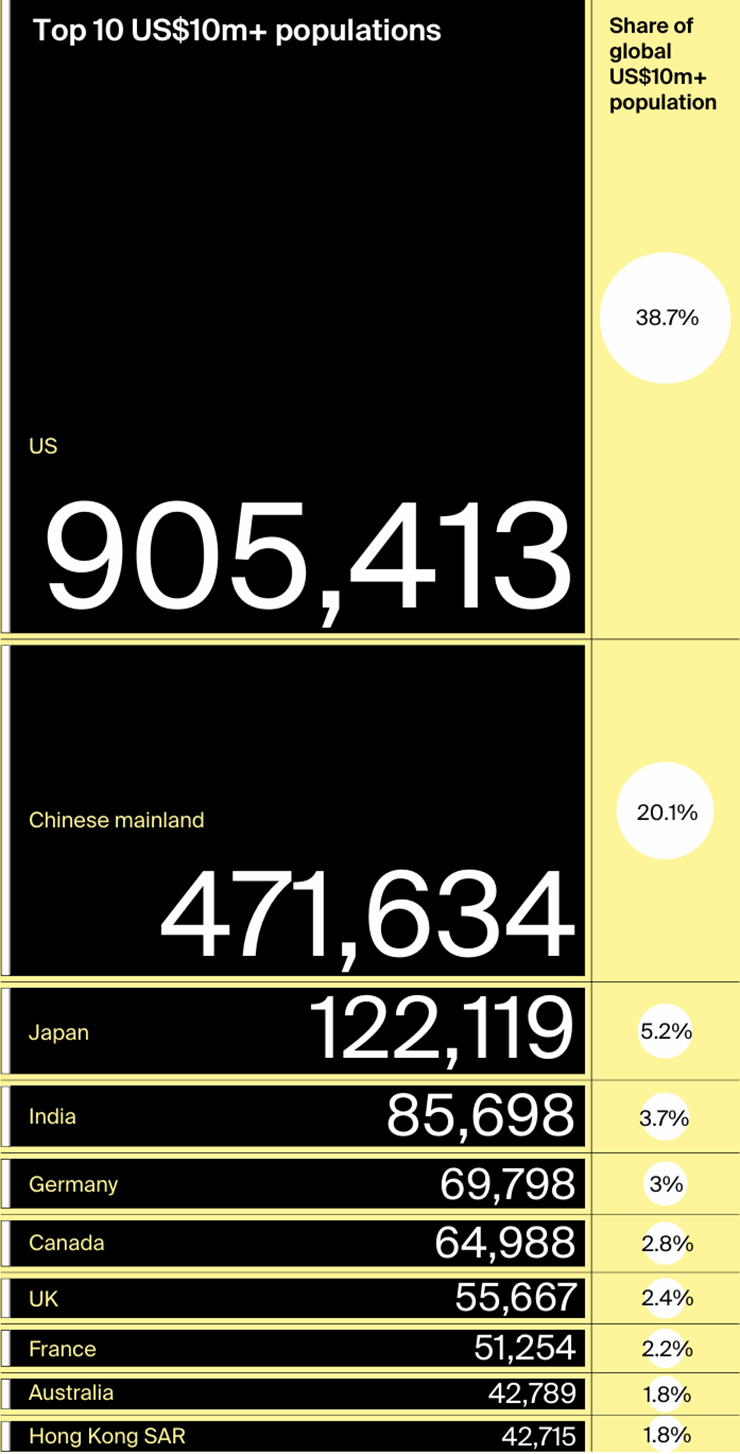

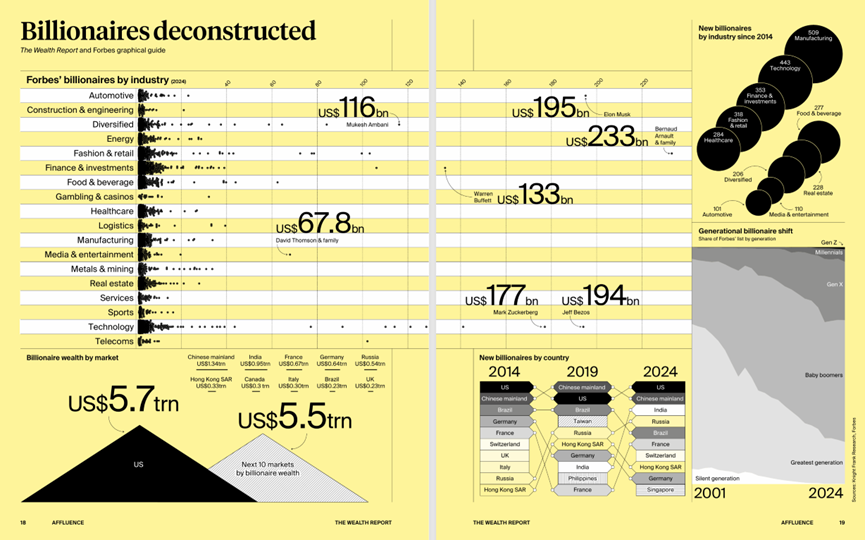

根据报告,美国目前拥有超过90万名千万美元以上的富豪,占据了全球高净值人群的近39%,在亿万富翁($100M+)这个层级,更是接近41%的全球占比。用一句话总结:全世界将近一半的超富人,都在美国。

Home to over 900,000 individuals with assets exceeding $10 million, the U.S. accounts for nearly 39% of the global HNWI population. Among centi-millionaires—those with $100 million or more—the U.S. commands an even more staggering 41% of the global share. In simple terms: nearly half of the world’s ultra-rich reside in America.

为什么是美国?理由很简单:它是全球最能创造“本土富豪”的国家:科技、金融、能源、军工、文化产业,多条赛道同时产出顶级巨头。同时它又是最能吸引全球富豪移民的国家:宽松的金融体系、世界级教育资源、完善的法治结构,仍然让无数家族选择把资产、子女、公司放在这里。

Why? Because America is still the world’s premier wealth engine—producing elite fortunes across tech, finance, energy, defense, and media. It’s also the number-one destination for wealth migration, offering a cocktail of open financial systems, elite schools, and a legal framework that prizes asset protection.

更重要的,是美国对“财富自由”文化的天然加持——在这里炫富不羞耻,成功不被打压,财富流动不是原罪。

Culturally, too, America offers something few others do: a deep-rooted belief in wealth as a virtue. In the U.S., success is celebrated, wealth is flaunted without shame, and social mobility remains an aspiration, not a threat.

但美国强,不代表其他国家就没有机会。

But America’s strength doesn’t imply stagnation elsewhere.

中国大陆以超过47万人位居全球第二,虽然近几年因政策与经济调整增长放缓,但仍然保有庞大的高净值人群基底。

China, with over 470,000 HNWIs, holds a solid second place, even as economic recalibrations slow its pace.

值得注意的是,印度正强势崛起,仅2023到2024一年,就增长了42%,达到8.5万人,成功跃升全球第四。随着“印度制造”、科技创业热潮和中产扩大,这种增速很可能持续。

India, however, is rocketing upward—adding 10,000 new millionaires in just a year to reach 85,000 HNWIs, ranking fourth globally. Fueled by manufacturing, digital entrepreneurship, and an expanding middle class, India’s rise looks sustainable.

简而言之:美国仍是财富之巅,但亚洲的潜力已经挡不住。

In short: America still leads, but Asia is no longer just catching up—it’s redefining the race.

◆ ◆ ◆ ◆

亚洲VS欧美:富人版“你追我赶”

Asia vs. the West: The Wealth Race That’s Reshaping the World

◆ ◆ ◆ ◆

如果说过去几十年是欧美主导的“老钱时代”,那么眼下,亚洲正在以肉眼可见的速度追赶。而且这不是简单的“增长”,而是一种结构性反转。

If the 20th century was the golden age of “old money” Europe and North America, the 21st is proving to be Asia’s century—fueled not just by growth, but by structural transformation.

从《财富报告2025》的数据看:

◆亚洲的高净值人群增长速度为5%,仅次于北美(5.2%),但在一些具体国家和城市,亚洲的增长率已经实现了全面“反超”;

◆中国大陆依然是高净值人口最多的亚洲国家,拥有超过47万人;而印度凭借科技创业、家族资本崛起,在一年内新增1万富豪,总人数达到8.5万,成为全球第四;

◆日本虽然经济增长放缓,但凭借稳健的财富管理和超高人均资产密度,依然稳居亚洲“老钱护城河”的代表。

According to The Wealth Report 2025:

◆Asia’s HNWI population grew 5%—second only to North America’s 5.2%—and in many key markets, it’s already overtaking the West.

◆China leads in Asia with over 470,000 millionaires, while India surged to fourth globally, riding a wave of startup innovation and family-owned capital.

◆Japan remains the region’s “fortress of old wealth,” offering stability, robust financial governance, and some of the world’s highest per capita asset holdings.

反观欧洲,过去一年仅实现了1.4%的增长,成为所有大陆中表现最弱的地区。老龄化、监管繁复、移民政策收紧、投资创新力不足,这些问题正在蚕食欧洲在全球财富体系中的话语权。

Meanwhile, Europe is losing ground. Growth in its HNWI population was a tepid 1.4%—the slowest among all continents. A confluence of aging demographics, overregulation, protectionist immigration policies, and sluggish innovation is chipping away at its global standing.

而在美国之外的北美,比如加拿大,也面临着类似问题。房地产泡沫高企、资产负债表紧张,加上税务趋严,导致不少富人开始外流或转向其他市场进行配置。

Even in Canada, cracks are showing. High real estate valuations, rising debt burdens, and increasingly stringent tax regimes are prompting the rich to look elsewhere.

说白了:西方还富着,但亚洲在快跑了。

Simply put: the West still owns the past, but Asia is sprinting toward the future.

更有趣的是,这场亚洲VS欧美的“富人对决”,已经不止局限在财富数字的比拼,而是开始转向下一代的布局——从身份规划、子女教育、资产传承,到绿色投资、家族办公室结构优化……亚洲新富人群正迅速学会“如何像欧美老钱那样当富人”。

What’s more, this contest is no longer about who owns more—it’s about who plans better. Asia’s new wealth class isn’t just expanding; it’s evolving—embracing green investment, multi-generational trusts, and the family office model once exclusive to Europe’s aristocrats and America’s dynastic elite.

这意味着,未来我们将不再只听到“硅谷、华尔街、伦敦金融城”,而会越来越多看到“孟买创业谷、新加坡家族办、杭州LP生态圈、首尔奢侈品资本”。财富格局,从未如此接近一次重新排序的时刻。

Expect to hear less about Wall Street and more about the Mumbai Startup Valley, the Singapore Family Office Corridor, Hangzhou’s LP landscape, and Seoul’s luxury capital nexus. A reordering of global wealth is not just coming—it’s already underway.

◆ ◆ ◆ ◆

下一个财富热土,为何轮到非洲?

Why Africa Is Becoming the Next Frontier for the Wealthy

◆ ◆ ◆ ◆

在全球财富版图中,“非洲”这个词,常年被人忽视。说起投资,大多数人的认知还停留在“资源依赖、政治不稳、基础薄弱”。但现在,越来越多高净值人群正悄悄把目光投向这片“被低估的大陆”。

Long dismissed in investment circles, Africa is quietly stepping onto the global wealth stage. To some, it still evokes images of instability, weak infrastructure, and risk. But savvy investors are waking up to a different picture.

是的,非洲正在成为下一个财富增长的热土。

Africa is poised to become the next great wealth frontier.

根据《财富报告》的预测,2024-2028年,非洲的千万美元以上富豪人数将增长17.8%,在所有地区中增速最快,远高于亚洲(6.9%)和北美(5.3%)。

From 2024 to 2028, the continent’s HNWI population is projected to grow by 17.8%—the fastest rate worldwide, outpacing Asia (6.9%) and North America (5.3%).

这并不是偶然,而是几股力量在悄悄汇聚:

What’s driving this? A powerful convergence of forces:

◆年轻人口红利:非洲是世界上人口最年轻的大陆,35岁以下人口占比超过70%。这不仅意味着劳动力红利,更孕育了巨大的内需市场和新一代数字创业者。

◆基础设施和金融科技崛起:在移动支付、电子钱包、普惠金融领域,非洲反而在“跨越式发展”,许多国家直接跳过传统银行阶段,催生出新型的财富生态系统。

◆自然资源与绿色投资热潮:可再生能源、碳汇林业、锂矿、太阳能等资源成为全球资本竞逐的新方向,非洲则恰好是这类“绿色资产”的最大供应地之一。

◆国际资本重新下注:随着中美在其他区域博弈加剧,非洲逐渐成为“相对中立的增量市场”。中东、亚洲和欧美家族办公室、主权基金纷纷开始战略布局,比如投资肯尼亚物流、卢旺达创新科技园、南非高端地产。

◆Demographic firepower: Africa is the youngest continent on Earth, with over 70% of its population under 35. This translates to both a workforce boom and an explosive consumer market.

◆Leapfrog finance: From mobile payments to inclusive banking, Africa is skipping legacy systems and pioneering its own fintech solutions.

◆Green asset treasure trove: Whether it’s lithium, solar, or carbon forestry, Africa is fast becoming the go-to supplier of the green commodities the world craves.

◆Geopolitical neutrality: As U.S.-China tensions heat up, Africa stands out as a relatively neutral, under-tapped growth zone. Capital from the Gulf, Asia, and the West is quietly flowing into logistics, innovation hubs, and premium real estate.

当然,非洲的风险依旧存在,政治稳定性和制度成熟度仍参差不齐。但在全球投资人眼里,它更像是20年前的东南亚,甚至是30年前的中国——尚未被开采的财富洼地。

Yes, political and regulatory challenges persist. But in the eyes of global capital, Africa today is what Southeast Asia was in 2000—or China in the 1990s: raw, risky, and full of unrealized potential.

谁先下场,谁就有机会抢占红利。所以,这一轮“全球富豪地图”的边界,正在南移。不要再小看非洲,它也许会是下一个迪拜、下一个新加坡的土壤,只不过故事还没完全开始。

In the new global wealth map, the lines are shifting south. Those who get in early may write the first chapter of Africa’s wealth renaissance.

◆ ◆ ◆ ◆

全球资产流动背后,藏着哪些信号?

Why This Matters to Everyone—Not Just the Rich

◆ ◆ ◆ ◆

当我们聊“富豪去哪儿了”“亿万资产在往哪个国家流”,很多人第一反应是:跟我有什么关系?但事实恰恰相反——当全球高净值人群集体行动时,他们其实正在悄悄改写普通人未来的财富机会。

When the ultra-rich shift assets or acquire new citizenships, it’s easy to shrug and say, “That’s not my world.” But here’s the truth: their moves are often a preview of yours.

这不是“阶层焦虑”,而是你我都绕不开的现实:

This isn’t fear-mongering—it’s foresight.

◆信号一:资产价值正在“地理重估”

过去我们总以为北上广深是永恒的资产洼地,但现在富豪的动作显示:真正优质的资产不是“在哪儿贵”,而是“在哪儿能穿越周期”。一个城市有没有安全感、政策支持、国际流动性,远比短期涨跌更重要。

◆Signal 1: Geography is being repriced

What once felt like safe bets—Shanghai, San Francisco, London—may no longer be the most resilient. In a post-pandemic, high-volatility world, investors prize policy clarity, global access, and institutional trust more than ever.

◆信号二:财富的安全边界在外移

当富人都把资产迁出本地,布局多个国家,你就该警觉——市场风险可能在加大,税务、政策和资产流动性将变成更重要的维度。哪怕不能全球资产配置,起码也要考虑多元化投资,降低单点风险。

◆Signal 2: Capital seeks protection, not just growth

As more wealth exits local markets, it’s a warning: risks are rising. Even if global diversification is out of reach, local investors should rethink asset concentration and seek broader safety nets.

◆信号三:下一代的起跑线在重排

富人为什么把钱投去新加坡、美国、非洲、澳洲?因为他们投的不只是房子,而是护照、身份、教育、医疗、社会网络……这些资源的集聚,很可能就决定了下一代的竞争力起点。

◆Signal 3: The next generation’s launchpad is shifting

Wealthy families aren’t just buying homes—they’re buying ecosystems: residency, healthcare, education, and network density. These “soft assets” are fast becoming the new competitive advantage.

◆信号四:财富机会仍在,但方向变了

过去你靠买一套房、炒个股,可能小赚一笔。但未来,要懂趋势、看全球、关注政策红利才有可能抓住“结构性增值”。信息差和认知差,正在变成新的财富鸿沟。

◆Signal 4: Opportunity still exists—but the formula has changed

Gone are the days when a house or a hot stock pick could change your life. The winners of tomorrow will be those who spot trends early, navigate policy shifts, and think globally. The gap is no longer just about money—it’s about mindset and access.

所以别再问“我不是富人,看这个干嘛”,因为富人做出的每一个决策,其实都是对世界风向的提前下注。

So the next time you hear where the rich are going—don’t roll your eyes.Watch carefully.

他们的地图,不是给我们看热闹的,是提醒我们:下一波机会在哪,下一波风险在哪,而你现在,站在什么位置上。

Because their map isn’t for show—it’s a preview of where the next fortunes, and the next crises, will unfold.