What Are the Wealthy Buying? Why Real Estate Remains Their Top Choice

◆ ◆ ◆ ◆

当全世界的钱开始流向“砖头瓦块”

When Global Capital Pours into Bricks and Mortar

◆ ◆ ◆ ◆

高利率时代、债务堆积、金融动荡……你以为富人会转向更灵活的投资标的,比如对冲基金、债券、科技股票?结果恰恰相反——他们正大批量把钱“砸向地面”。

Soaring interest rates. Mounting debt. Financial turbulence. You might expect the wealthy to retreat into more agile assets—hedge funds, bonds, tech stocks. But the truth is just the opposite: they're pouring money into the ground.

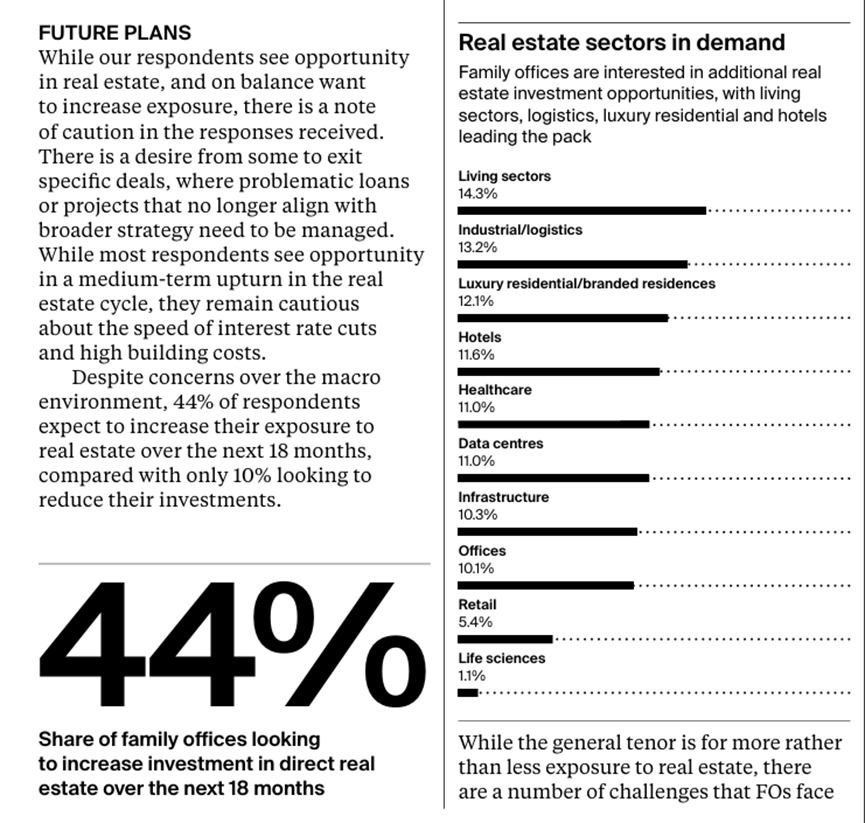

根据《财富报告2025》,全球超过44%的家族办公室正计划在未来18个月加大房地产配置,其中既包括商业地产,也包括高端住宅。

According to The Wealth Report 2025, more than 44% of global family offices plan to increase their real estate allocations over the next 18 months, spanning both commercial and high-end residential properties.

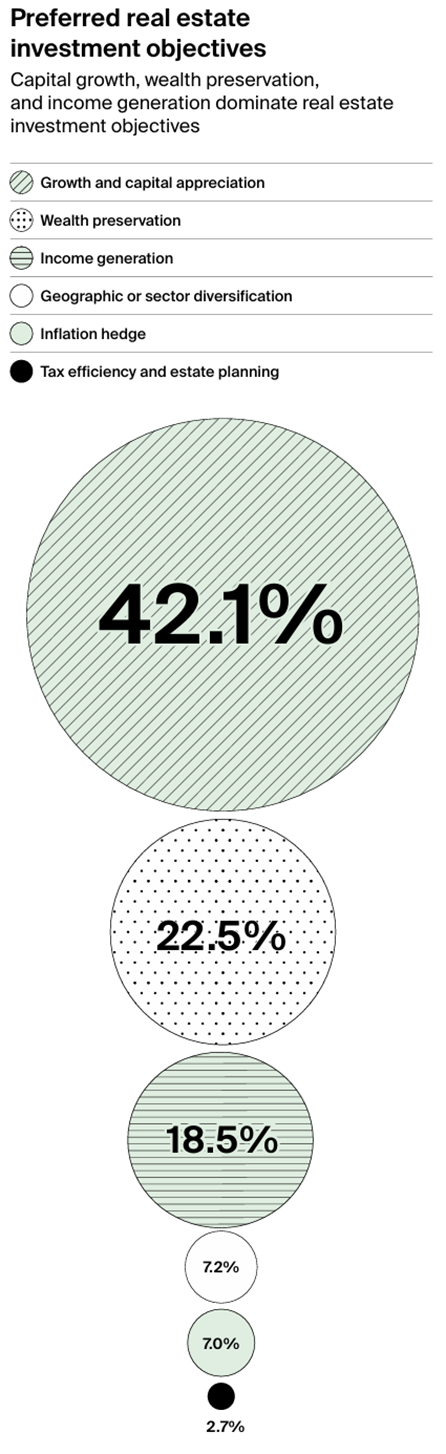

如果再往前看,这不是一次性行为,而是一个持续五年的趋势。早在疫情初期,当资产市场剧烈震荡时,富人群体就开始“去虚向实”:减持高波动性资产,增加可控、抗通胀、可传承的实物资产。而房地产,几乎成为他们最坚定的选项。

This isn’t a reactionary move—it’s a long-term trend that began five years ago. At the onset of the pandemic, when asset markets were in chaos, the wealthy began shifting from volatility to tangibility. They reduced holdings in high-risk instruments and increased their exposure to real assets—those that are controllable, inflation-resistant, and transferable across generations. Among all options, real estate emerged as their most reliable anchor.

2021年之后,全球房地产市场进入利率拐点,大量机构资金退出,但富人却在“接盘”,他们买楼、包地、投资物流园区、长租公寓、养老住宅……这些看起来“慢、重、不性感”的资产,反而最让他们安心。为什么?因为在他们眼中,房地产不是资产,是堡垒。

Since 2021, as interest rates surged and institutional capital withdrew from property markets, wealthy individuals stepped in to “catch the falling knife.” They’ve been buying office buildings, land parcels, logistics hubs, long-term rental apartments, and senior living communities. These slow-moving, capital-intensive, and often “unsexy” assets give them the one thing money can’t always buy—peace of mind. To them, real estate isn’t just an asset. It’s a fortress.

当你不知道未来税制怎么改、货币怎么贬、战争在哪爆,能落地、能持有、能对抗通胀、还能“住人”的房产,简直就是财富的避险岛。

In a world where tax policies shift, currencies weaken, and conflict looms, physical property offers something unique: a tangible, livable, inflation-hedged anchor for wealth.

也正因为如此,富人不在乎短期涨幅,而在意是否“能拿得住”。他们投资房地产,不是为了翻倍,而是为了稳住整个家族财富的底层基石。

That’s why the wealthy don’t chase quick returns. They’re looking for longevity and durability. They don’t invest to double their money—they invest to protect their foundation.

◆ ◆ ◆ ◆

家族办公室热衷什么类型的房产?

What Kinds of Real Estate Are Family Offices Actually Buying?

◆ ◆ ◆ ◆

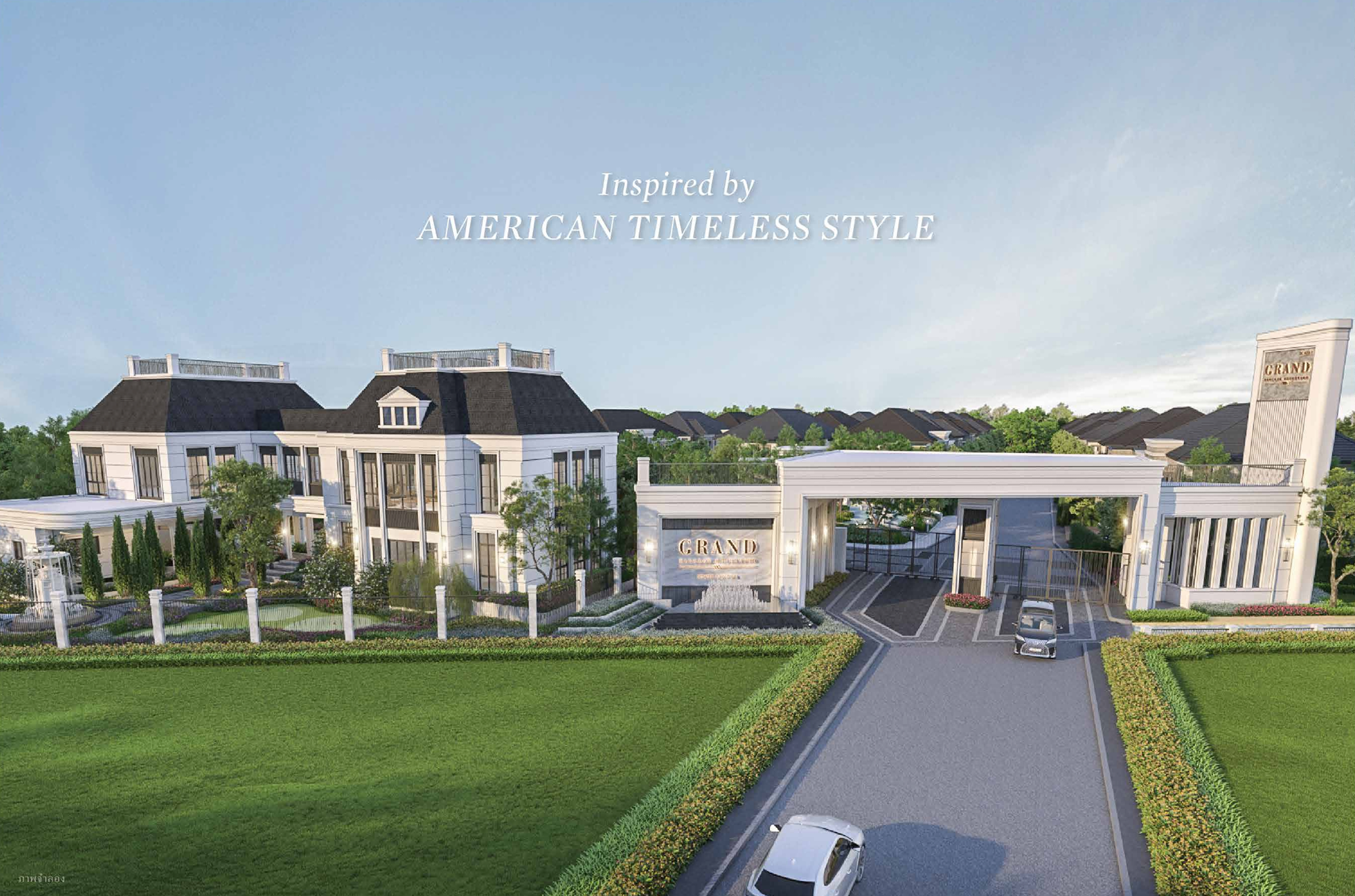

当我们提到“富人买房”,很多人脑中浮现的可能是海景大别墅、城市顶楼公寓。但在现实中,真正掌握财富话语权的家族办公室,买的可不止是“豪”。 他们更看重的是“稳”与“稀缺”。

When we think of wealthy investors, we often picture lavish seaside villas or sleek penthouses. But in reality, family offices—the powerhouses behind multigenerational wealth—aren’t just chasing luxury. They're seeking stability and scarcity.

根据《财富报告2025》的家族办公室调研数据显示:25%的家族办公室计划在未来18个月内增持住宅类资产;44%的家族办公室表示将加码商业房地产,尤其是写字楼、物流仓储与生活配套型物业。这透露出一个关键信号:他们不只是“买房”,而是“买结构性资产”。

According to The Wealth Report 2025, 25% of family offices plan to increase their holdings in residential assets. Meanwhile, 44% plan to grow their exposure to commercial real estate—especially offices, logistics centers, and community infrastructure. The key insight? They’re not just buying homes. They’re buying structural assets.

以下是他们青睐的几种热门品类:

Here’s what they’re targeting:

① 核心城市的“甲级写字楼”

特别是伦敦、东京、新加坡等一线城市。尽管办公租赁需求整体下滑,但真正稀缺的、高环保评级的A级办公楼却供不应求。Knight Frank在伦敦统计,目前已有62家企业在抢占面积5万平方英尺以上的写字楼,排队时间甚至长达3年。富人们投的是“企业刚需”和“供给稀缺”的双重确定性。

Prime office buildings in global cities

Despite a broader downturn in office demand, high-rated, green-certified Grade A office buildings in cities like London, Tokyo, and Singapore are in short supply. Knight Frank reports that in London alone, 62 companies are competing for offices larger than 50,000 square feet, with waitlists stretching up to three years. The wealthy are betting on two certainties: corporate demand and supply scarcity.

② 长租公寓、养老社区、学生公寓

这类物业背后的逻辑是人口结构。不论是老龄化国家的养老地产,还是国际教育中心城市的学生宿舍,或是大都市租房主力需求的长租项目,都拥有稳定现金流,是优质“类债券型”资产。

Build-to-rent, senior living, and student housing

These property types are driven by demographics. Whether it’s senior housing in aging nations, student dorms in global education hubs, or long-term rentals in major cities, these assets offer stable, bond-like cash flows.

③ 可持续、低碳建筑

环保已经不再是“姿态”,而是实打实的投资标准。年轻富豪、家族第二代尤其关注ESG属性,愿意溢价购买绿色建筑。Knight Frank数据中,绿色认证写字楼的租金溢价已高达18%。

Sustainable, low-carbon buildings

Environmental sustainability is no longer a token gesture—it’s an investment standard. The second generation of wealthy families, especially younger heirs, prioritize ESG features and are willing to pay premiums for certified green buildings. Rental premiums for such assets can reach up to 18%.

④ 小众类高净值资产:酒庄、马场、精品酒店

这类资产不只是“可居”,更是身份象征、生活方式入口,甚至能延伸为新业务线,如高端酒类品牌、农场IP化运营、精品旅宿等。背后逻辑是“资产+文化+产业”的多重价值叠加。

Lifestyle-driven assets: vineyards, equestrian estates, boutique hotels

These aren’t just residences—they’re lifestyle statements. From luxury wine production to branded farm operations and boutique hospitality, the value lies in combining asset, identity, and culture.

换句话说,富人并不是在“炒房”,而是在建造一个个资产堡垒系统。每一套物业,都是他们家族稳定、收益、传承、隐私、防风险能力的一部分。

In short, the wealthy aren’t speculating. They’re constructing long-term wealth systems, where every property plays a role in income, privacy, risk mitigation, or legacy.

◆ ◆ ◆ ◆

买的不只是房,是“掌控感”与“身份门票”

They’re Buying More Than Real Estate—They’re Buying Control and Identity

◆ ◆ ◆ ◆

你以为富人买房只是为了保值?其实,他们买的从来不是“房子本身”,而是附着在房子上的一切隐形价值。对高净值人群来说,资产配置不是“投资”两个字就能概括的,它更像是一种主动构建身份和控制权的方式。

The ultra-wealthy aren’t buying homes just to preserve value. They’re buying access, autonomy, and influence. Property is no longer just a financial product—it’s a personal operating system.

我们来拆解几个富豪买房时真实考量的“隐性逻辑”:

Here’s what they’re really acquiring:

1. 买的是“身份入场券”

在某些国家,比如葡萄牙、西班牙、希腊,购房不仅是资产配置,更是通向欧盟身份的一张“门票”。而在阿联酋、马来西亚、新加坡等地,购房几乎等同于拿“居留卡”。这类“房产+身份”的捆绑模式,让房子成为通行全球、优化税务结构、给下一代创造全球选项的重要载体。一句话总结:富人买房,也是在给未来10年的自由布局投票。

1. A passport to global freedom

In countries like Portugal, Spain, and Greece, buying property opens the door to EU residency. In Singapore, the UAE, or Malaysia, real estate often unlocks long-term visas. These hybrid property-passport models allow the wealthy to hedge against political uncertainty and plan for their children’s global mobility.

2. 买的是“风险对冲仓”

在宏观不确定性变成常态的今天,没有人能完全预测政治风向、监管变化或货币走向。而房产作为“实物锚点”,提供了一种非常稀缺的“局部主权”感——哪怕银行动荡、市场暴跌,你仍然能握有一套独立产权的实体资产,可以出租、变现、传承,甚至逃生。这是对“系统性风险”的私人防线。

2. A hedge against macro risk

When the future feels unknowable, physical assets provide a rare sense of sovereignty. Amid financial crises or currency devaluation, real estate stands as an independent store of value—rental-ready, inheritable, and, if necessary, an escape route.

3. 买的是“家族掌控权”

尤其是家族办公室,买下一整栋物业,不仅是为了资产回报率,更是为了不依赖别人。从自己人管理物业、选择租客,到定制税收与家族信托结构,富人买的不只是资产,而是把关键节点“掌握在自己人手里”。这就是为什么很多富豪买楼后不急着出租——对他们来说,“空置”不代表亏损,反而是一种保留控制权的方式。

3. Full-spectrum control

Family offices often buy entire buildings—not for income, but for control. From handpicking tenants and staff to structuring trusts and taxes, they keep decision-making within the family. Vacancies aren’t seen as losses, but as preserved flexibility.

4. 买的是“圈层与教育资源”

例如,伦敦富人区的一栋房产,不只是学区房,更是进入“金融贵族圈”的通行证;在东京、巴黎买房,很多时候是为了孩子能以本地身份就读优质公校,或融入更国际化的社交圈层。房子只是“票根”,真正贵的,是能进入的那个世界。

4. Access to elite circles and education

In London, a home in the right neighborhood isn’t just a house—it’s entry into elite financial and social networks. In Tokyo or Paris, owning property can give children local status, access to top schools, and integration into global communities.

所以别再问“他们为什么买那么多房”,真正的问题是:你有没有想清楚,自己买房到底在买什么?对富人来说,这是主动建构人生选项的方式;对普通人来说,或许也是一个该思考的提醒。

So stop asking, “Why do they buy so much real estate?”The better question is: Do you truly understand what you’re buying when you buy a home? For the rich, it’s a deliberate construction of options. For the rest of us, it might just be the reminder we need to reflect deeper.

◆ ◆ ◆ ◆

全球住宅、商业地产的“新黑马”

The New Global Real Estate “Dark Horses”

◆ ◆ ◆ ◆

如果说纽约、伦敦、新加坡是富人投资地产的“老三样”,那今天,全球正悄悄冒出一批“新黑马”城市和物业类型,正在悄然接住全球财富的转场。这些黑马的共性并不是“便宜”,而是具备未来十年的结构性红利:人口净流入、国际资本涌入、制度友好、产业转型明确。我们来一一拆解:

If New York, London, and Singapore are the traditional favorites for property investment, a new generation of “dark horse” cities and asset types is quietly emerging—ready to catch the next big wave of global wealth migration. These emerging stars aren’t attractive because they’re cheap, but because they offer structural advantages for the next decade: net population inflow, international capital entry, regulatory friendliness, and clear industrial transformation.Let’s break it down:

商业地产:冷门赛道正在升温

虽然全球整体投资量较2021年高点下滑近60%,但冷静看细分市场,以下几类正在逆势走强:

◆物流与仓储物业:电商、高端制造、医药冷链的快速发展,让全球物流中心城市(如法兰克福、芝加哥、深圳前海)迎来新一轮“硬资产黄金期”。

◆医养地产 & 医疗办公综合体:老龄化趋势带动了养老住宅、康复中心和高端护理机构的地产投资热,尤其在澳大利亚、日本和北欧。

◆新型办公社区:不再是传统CBD单体写字楼,而是“办公+生活+社交”三合一的混合物业,正在欧洲、美国硅谷、加拿大多伦多等科技重镇流行。

1. Commercial Real Estate: Niche Sectors Are Heating Up

While overall global investment has dropped nearly 60% from its 2021 peak, specific sub-markets are rising against the tide:

◆Logistics and Warehousing – Driven by e-commerce, advanced manufacturing, and pharmaceutical cold chains, logistics hubs like Frankfurt, Chicago, and Qianhai (Shenzhen) are entering a new “hard asset golden era.”

◆Medical and Senior Living Real Estate – The aging population is fueling investment in elderly care facilities, rehab centers, and premium healthcare complexes, particularly in Australia, Japan, and the Nordic countries.

◆Next-Gen Work Communities – Traditional CBD towers are giving way to mixed-use spaces combining “work + life + social” functions, now popular in tech-heavy hubs like Silicon Valley, Toronto, and cities across Europe.

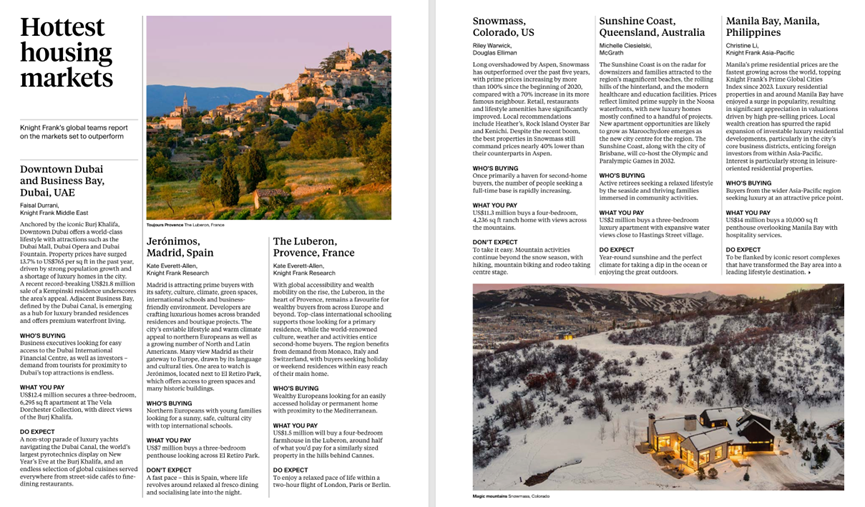

住宅资产:不仅看地段,更看“生活构成”

除了传统豪宅和高端学区房外,一些具备“独特生活方式场景”的城市也在受到富人青睐:

◆里斯本、马德里、雅典:靠“阳光+税收优惠+身份通道”吸引大量欧洲、中东、中资高净值人群;

◆新西兰奥克兰、加拿大温哥华:主打生态健康、安全宜居,成为年轻富人移居目的地;

◆日本札幌、韩国釜山:生活节奏相对轻松,房产仍有“可负担性”,成为亚洲小众资本的新宠。

2. Residential Assets: It’s Not Just About Location, But Lifestyle

Beyond traditional luxury homes or elite school districts, cities offering unique lifestyle scenarios are gaining traction with the wealthy:

• Lisbon, Madrid, Athens – Drawing high-net-worth individuals from Europe, the Middle East, and China with “sunshine + tax perks + residency access.”

• Auckland, Vancouver – Promoting wellness, security, and eco-living, these cities are ideal destinations for younger wealthy migrants.

• Sapporo (Japan), Busan (Korea) – With a more relaxed pace of life and still-affordable property prices, they’re becoming favorites for Asia’s boutique investors.

“超细分”趋势:富人买的是情绪场景

除了资产功能性,越来越多投资正流向富人情绪投射的方向:

◆精品酒庄与农场(南非、法国、智利)

◆高端康养度假物业(西班牙、泰国普吉岛)

◆城市近郊“庄园式私宅”(英国南部、日本轻井泽)

这些资产不仅能出租运营,更能为家族构建“精神领地”与仪式感,正成为新一代富人“自用兼投资”的双向选择。

3. Ultra-Niche Trends: Wealth as an Emotional Landscape

Beyond functionality, more capital is flowing into properties that fulfill emotional aspirations:

◆Boutique wineries and farmland (South Africa, France, Chile)

◆Luxury wellness retreats (Spain, Phuket, Thailand)

◆Suburban manor estates (Southern England, Karuizawa in Japan)

These assets aren’t just rentable—they create “emotional sanctuaries” and family rituals, making them dual-purpose investments for use and legacy.

结论很清晰:传统房产正在向多元结构性资产演变,而“黑马”城市和“新概念物业”,正是下一个十年真正的风口。

The conclusion is clear: traditional real estate is evolving into multi-structured assets, and these “dark horse” cities and “new concept” properties are shaping the next decade’s real estate boom.

◆ ◆ ◆ ◆

普通人能否“抄作业”?

看懂富人买房的底层逻辑

What Can Everyday Buyers Learn from the Ultra-Wealthy?

◆ ◆ ◆ ◆

看到这里,你也许会问:这些家族办公室动辄买楼、包区、全球配置,跟我有什么关系?我月薪2万,房贷还没还完,能学点啥?

At this point, you might be wondering: these family offices are buying entire buildings, developing global portfolios—what does that have to do with me? I earn ¥20,000 a month and haven’t paid off my mortgage yet—what’s there to learn?

其实答案就在于:你未必需要复制富人的“买房方式”,但必须理解他们“买房逻辑”的底层原理。

The truth is: You don’t have to copy their buying power. But you must understand the logic behind their purchases.

以下这几点,不管你资产几位数,依然值得参考:

Here are a few principles worth keeping in mind, regardless of your income:

1. 房子是“长期现金流工具”,不是“短炒暴富产品”

富人从不指望一套房能立刻升值翻倍,他们更关心是否稳定、是否抗风险、是否可传承。普通人也不必过分追求“买房就赚钱”,而应把焦点放在:能不能出租?有没有折旧风险?是不是处在结构性红利区域?

1. Real estate is a long-term cash flow tool—not a quick-flip asset

The wealthy don’t expect a single property to double in value overnight. They care about whether it’s stable, risk-resistant, and inheritable. Ordinary buyers shouldn’t over-focus on making instant profit either—the real questions are: Can it be rented out? Is depreciation a concern? Does it lie in a structurally sound region?

2. 资产配置不等于“买最多”,而是“买得巧”

你没法像富人那样买遍全球,但可以理解他们“低关联、多区域”的分布逻辑:如果你的90%资产都压在一个城市的住宅上,那你比谁都脆弱。能否尝试配置一点REITs、车位、轻资产商铺,甚至优质理财类物业,都是降风险的方式。

2. Asset allocation isn’t about owning more—it’s about owning smart

You might not be able to buy properties across the globe, but you can adopt the logic of diversified, uncorrelated exposure. If 90% of your wealth is tied to one apartment in one city, you’re more fragile than you think. Can you consider REITs, parking spaces, light-commercial shops, or income-generating “semi-financial” properties?

3. 看懂“房子背后的政策风向”

富人买房不仅是因为看好城市本身,更因为那里有身份规划、税收优化、教育资源等“看不见的红利”。普通人买房时,也别只看地段,更要留意:这个区域有没有产业支撑?有没有人口净流入?有没有城市战略扶持?有没有“政策催化”?这些,才是决定资产保值能力的真正变量。

3. Look beyond location—watch the policy winds

The wealthy invest not just because they like a city’s vibe—but because it offers residency pathways, tax optimization, education opportunities, and other hidden benefits. When buying property, don’t just chase popular neighborhoods—ask: Is there industrial support? Population inflow? Government incentives? These are the real variables that determine asset durability.

4. 真正的房产价值,是“控制权”

房产不一定是收益最高的投资品,但却可能是你人生中最具掌控感的底层资产——它能给你家庭的安全感、子女的教育规划、租金收入的底层保障。不要小看那套房子能带来的“心理稳定性”,它甚至是抗周期的心理锚点。

4. Real value lies in “control”

Property might not be the highest-yielding asset, but it can be your most controllable foundational one. It offers your family stability, education planning, and rental income security. Don’t underestimate the psychological peace that comes from owning your home—it may be your most important emotional anchor in volatile times.

所以,不是要你也去买迪拜别墅,而是提醒你:在这个高波动的时代里,看清富人布局逻辑,就等于给自己多加一层认知防护罩。

So no, you don’t need to buy a villa in Dubai. But you should take this as a reminder: In this era of uncertainty, understanding the logic behind wealthy buyers’ strategies is like adding a cognitive buffer to your financial decisions.

未来不属于“买得最多”的人,而属于看得最懂的人。

The future won’t belong to those who buy the most—but to those who see the clearest.

点“阅读原文”了解更多