How Do Young Billionaires Approach Asset Allocation?

◆ ◆ ◆ ◆

Z世代富豪崛起,他们的投资风格和老钱不一样

The Rise of Gen Z Wealth and How They're Redefining Investing

◆ ◆ ◆ ◆

在传统印象中,富人是老练的、保守的、注重家族传承的。但现在,这种画面已经开始被改写。

Traditionally, the wealthy were seen as seasoned, conservative, and focused on family legacy. But that image is being rewritten.

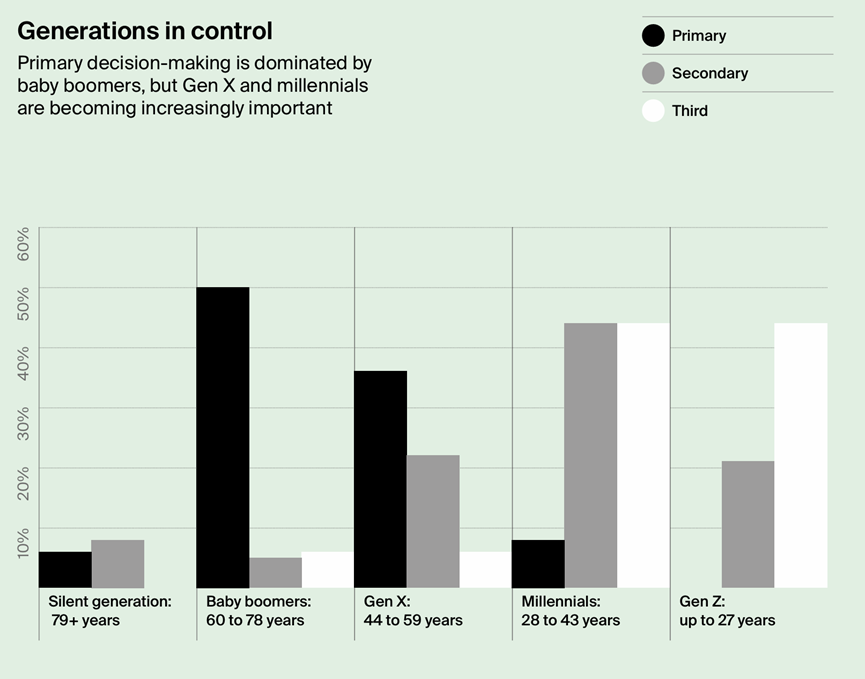

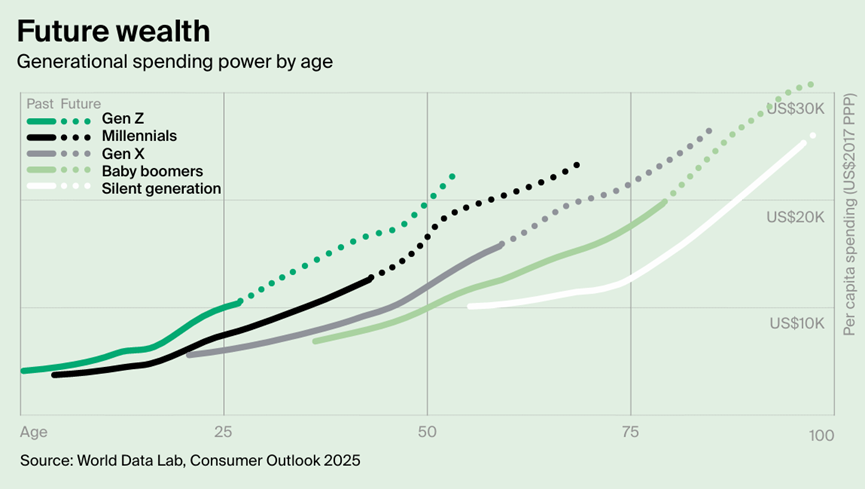

根据《财富报告2025》中的数据显示:全球范围内,40岁以下的高净值人群比例正在持续上升,其中亚洲和中东的增速尤为显著。

According to The Wealth Report 2025, the proportion of high-net-worth individuals under 40 is steadily rising worldwide, with the most rapid growth occurring in Asia and the Middle East.

这些“Z世代富豪”并不是老钱的接班人,而是自己通过创业、投资、数字资产迅速崛起的新贵。他们更年轻、全球化程度更高、受教育背景更多元,也更愿意用资产表达态度。

These “Gen Z billionaires” aren’t heirs of old money—they’re self-made, rising through entrepreneurship, investment, and digital assets. They’re younger, more global, better educated, and more willing to use wealth as a form of self-expression.

传统富人买房、买股票、投基金;而年轻富豪,则在布局NFT艺术、ESG企业、绿色农业、可持续酒庄,甚至投身太空科技、再生医学、心理健康行业。

While traditional investors buy real estate, stocks, and mutual funds, young billionaires are allocating capital into NFT art, ESG enterprises, sustainable agriculture, boutique wineries—and even space tech, regenerative medicine, and mental health ventures.

他们对财富的理解更具“情绪价值”:一份资产是否环保?一套房子能否代表我追求的生活方式?投资这个品牌,是不是在参与一种文化共创?

They bring a new emotional dimension to investing:Is this asset environmentally sustainable? Does this home reflect my lifestyle ideals? By investing in this brand, am I co-creating a culture I believe in?

Z世代不是不重视回报,而是更重视“我投的东西,是否代表我是谁”。在这个群体中,资产已不再只是财富的延伸,更是价值观的具象化。他们不再只问“值不值”,而是“值不值得我支持”。

They care about returns, yes—but even more about whether their investments represent who they are. For them, assets aren’t just about wealth—they’re reflections of values. They ask not just “Is it worth it?” but “Is it worth standing behind?”

这也意味着,未来的投资逻辑,正在从“收益导向”进化为“身份导向”——这不只是富豪圈的变化,也可能是整个社会新财富观的先行风向。

This signals a shift in investment logic—from return-driven to identity-driven. And this isn’t just a trend within elite circles—it could be an early signal of a broader shift in how society views wealth itself.

◆ ◆ ◆ ◆

“环保+有态度”资产:钱投给价值观

Value-Driven Capital: Investing in Beliefs, Not Just Profits

◆ ◆ ◆ ◆

年轻富豪最大的特征不是钱多,而是“价值敏感度高”。他们不像传统富人那样只看回报周期、波动率、现金流,而是更看重一件事:这笔钱投出去,是不是在帮我支持一个我认同的世界?

The most defining feature of young billionaires isn’t how much money they have—it’s how deeply they care about values. Unlike traditional wealth holders who prioritize return cycles, volatility, and cash flow, Gen Z asks a different question: “Is my capital building the world I want to live in?”

这一代富豪成长于社交媒体时代,从小接受可持续、环保、多元包容等理念的浸润。他们更关心地球能不能变好,社会有没有变公平,人类的未来是否值得期待——所以他们的投资,不再是“赚不赚钱”,而是“对不对得起良心”。

They were raised in the age of social media, shaped by values like sustainability, environmental responsibility, and social inclusion. They care about whether the planet is healing, whether society is becoming more just, and whether the future is hopeful.

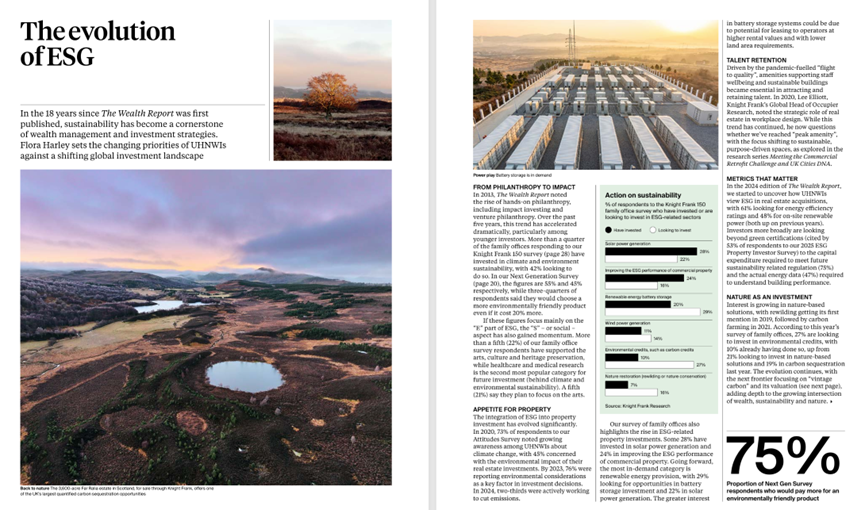

在《财富报告2025》中,Knight Frank调查发现:近一半的40岁以下富豪,已将ESG(环境、社会、治理)因素纳入个人或家族资产配置的核心考量;碳中和项目、绿色能源、可持续农业成为他们近年来配置比例上升最快的资产类别;很多年轻投资者甚至主动排除“负面资产”,如污染企业、低人权供应链公司、不透明的金融产品。

According to The Wealth Report 2025 by Knight Frank: Nearly 50% of billionaires under 40 incorporate ESG (Environmental, Social, Governance) factors as core pillars of their asset allocation. Carbon-neutral projects, green energy, and sustainable farming are the fastest-growing sectors in their portfolios. Many actively exclude “negative assets” such as polluting industries, companies with exploitative supply chains, and opaque financial instruments.

他们会投资一家使用环保包装的消费品牌,支持一家致力于心理健康的初创企业,资助可再生材料的创新研发项目——不仅因为可能盈利,更因为这些事让他们觉得“骄傲”。这是一种典型的“价值观驱动投资”(Value-Based Investing)。对他们而言,资本不再是冷冰冰的工具,而是改变世界的方式。他们不想只做看客,更想成为参与者、推动者。

They might back a consumer brand with sustainable packaging, invest in a mental health startup, or fund a renewable materials lab—not just for profit, but because it aligns with their identity. This is value-based investing. To them, capital isn’t cold or clinical—it’s a tool to shape the world. They don’t want to just profit from change; they want to be part of making it.

而这波“有态度的投资风”,也正在从富人圈外溢到大众市场:比如我们熟悉的绿色债券、ESG基金、可持续REITs等,都是这场思潮的“延伸产品”。也许不久的将来,不讲环保、不负责任的资产,就会被这批年轻金主主动抛弃。

And this shift is spreading. Products like green bonds, ESG mutual funds, and sustainable REITs are just the retail reflections of this mindset. In the near future, assets lacking responsibility or transparency may be naturally screened out—by both institutional investors and Gen Z leaders alike.

◆ ◆ ◆ ◆

从豪宅到葡萄园,资产也是一种生活方式

From Mansions to Vineyards: Assets as Lifestyles

◆ ◆ ◆ ◆

你可能想象不到,越来越多年轻富豪在资产配置清单里写下的,不是“写字楼”或“基金”,而是——葡萄园、马场、艺术工作室,甚至一片可以打理农场的山地。他们的思路非常简单:钱不是为了守,而是为了活得更像自己。

You might not expect it, but many young billionaires are now adding vineyards, horse ranches, or art studios—not just office buildings or hedge funds—to their portfolios.Their mindset is simple: wealth isn’t about preservation—it’s about designing a life that feels like you.

Knight Frank 在报告中指出,Z世代富人正在重新定义“财富的意义”,他们将资产与个人兴趣、精神寄托、生活美学深度绑定。你可以说这是“感性”,但实际上,这是比传统“买房保值”更有结构性的布局逻辑。

According to Knight Frank, Gen Z elites are redefining the meaning of wealth. They deeply connect their assets with personal passions, aesthetics, and spiritual pursuits.You might call this “emotional,” but in reality, it’s a highly structured form of lifestyle-led investment.

比如,买葡萄园,不只是喝酒的浪漫

Vineyards Are More Than Just About Wine

法国波尔多、意大利托斯卡纳、新西兰南岛——这些地方的精品酒庄,近年来在富人圈里爆火。他们投资的不只是土地和酿酒器材,而是一个带有品牌、农业、文化、社交、身份的“微型资产宇宙”。一座酒庄,既能经营,又能传承,既是生活场景,又是品牌出口,还能和朋友、家人共创记忆。

Bordeaux, Tuscany, New Zealand’s South Island—boutique wineries in these regions have become hot investments. These aren’t just real estate plays—they’re micro-universes combining branding, agriculture, culture, and social capital. A vineyard can be a business, a legacy project, a life experience, and a memory-making space with loved ones.

又比如,买马场,是一种生活圈层的重构

Horse Ranches = Redefining Family Lifestyles

英美的贵族马术文化、日本的轻井泽马术学校,正在吸引越来越多富二代或新富人家庭参与他们买马、建场,不是为了炫富,而是把“孩子怎么长大”这件事也纳入资产逻辑中。

Aristocratic equestrian culture in the UK and US, or Japan’s Karuizawa riding schools, are attracting new-money families. They’re not buying horses to flaunt wealth—but to weave family growth into their asset strategy.

艺术、建筑、文化空间,是“软价值投资”

Art, Architecture, and Culture = “Soft Value Assets”

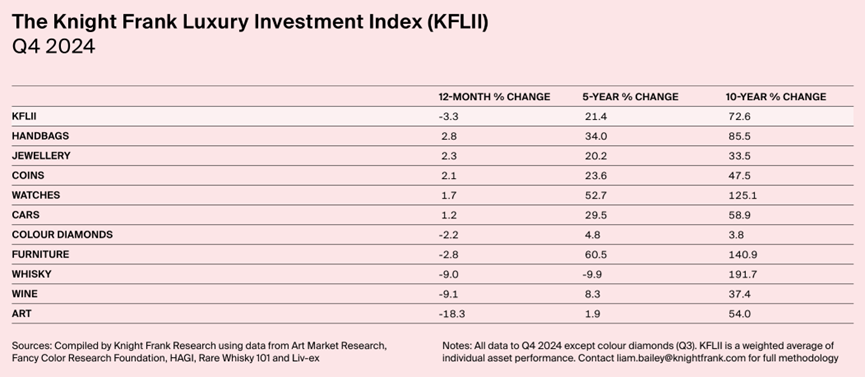

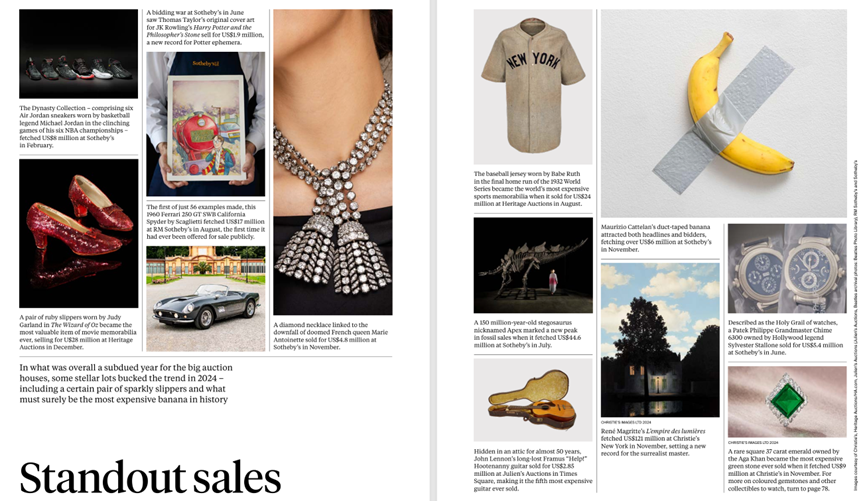

除了地产、能源等硬资产,年轻富豪更愿意投资小众设计品牌、博物馆计划、艺术家驻地空间。他们希望通过投资表达美学立场,甚至是对某种社会议题的支持(女性议题、环保设计、心理疗愈等)。这些配置未必有稳定现金流,但却有“故事感”和文化资产的潜在溢价。

Beyond traditional real estate and energy, young billionaires increasingly invest in niche design brands, museum programs, and artist residencies. These ventures don’t always yield stable cash flow—but they’re rich in storytelling and cultural capital. They signal taste, social engagement, and values.

总结一句话:年轻富豪的资产,不是冷冰冰的Excel,而是有血有肉、有情绪有温度的生活剧本。他们不只是用钱赚钱,更是用钱定义“自己是谁、过怎样的生活”。

In a sentence: For Gen Z billionaires, portfolios are no longer just spreadsheets—they’re personal life scripts. Money isn’t just about multiplication; it’s about identity.

◆ ◆ ◆ ◆

金融+文化的双重绑定,Z世代押注的不是回报率

When Finance Meets Culture: Gen Z Isn’t Just Investing for Returns

◆ ◆ ◆ ◆

过去,资产配置是一种理财行为。今天,在Z世代富豪手中,它越来越像是一种文化行为。

Once, asset allocation was just financial strategy. Today, for Gen Z, it’s also cultural strategy.

他们买资产的方式,和他们听的音乐、穿的潮牌、用的App一样,都带着强烈的审美和表达意图。这一代富人正在打造一种新的“金融文化”——钱,是用来参与文化构建,而不是只放进银行生利息。

They buy assets the same way they choose music, fashion, or social platforms—driven by aesthetics and expression. They're creating a new “financial culture,” where money is a tool not for passive interest—but active cultural participation.

他们不太愿意参与传统意义上的“炒房”、“投机”,也不会把全部身家压在一个不懂的领域。与其说他们是投资人,不如说是“文化联合创作者”,资产只是他们表达观点的一种媒介。

They avoid traditional speculation, won’t blindly buy into markets they don’t understand, and often seek meaning over momentum. Call them cultural co-creators, not just investors.

文化+金融的绑定,正在发生三种转变

Three Transformations in Culture-Driven Finance:

① 资产从“看不懂”变成“要共鸣”

年轻富豪倾向投资他们熟悉的东西,比如自己成长环境中的游戏IP、潮流品牌、新能源车、新式茶饮。他们不是看数据,而是看情感认同。这就是为什么你看到很多人投资潮玩公司、投小众音乐平台、支持主打环保理念的新餐饮——这不仅是资本行为,更是“投给自己成长记忆”的一种方式。

② 投资对象必须有“态度”和“故事性”

传统金融机构爱看财报、模型和市盈率,而年轻富人更爱问:“你们公司支持什么理念?团队是不是多元?有没有社会贡献感?”如果一个项目讲不出好故事、没有文化辨识度,那就算财务模型再漂亮,也未必打动他们。

③ 投后管理,是“圈子运营”

过去的富人是“投完了就等分红”,现在Z世代富豪是“投完之后希望成为品牌的一部分”。他们会参与品牌战略、社群管理,甚至直接出镜代言、做联名企划。很多人不只是投资人,而是活跃在品牌内容里的“超级用户”。这种深度参与感,也意味着他们不再是“冷静的资本”,而是“热情的社区创造者”。

① From “Unfamiliar” to “Emotionally Resonant”

They invest in what they know—gaming IPs, streetwear brands, EVs, modern tea startups. What matters isn’t just numbers, but whether it resonates with their background and identity.

② Investment Targets Need “Attitude” and Storytelling

They ask: Does your brand stand for something? Is your team diverse? Are you making a social contribution? If your brand lacks story or cultural signal, strong financials alone won’t suffice.

③ Post-Investment = Community Building

They don’t just invest—they join. They contribute to brand strategy, co-create products, even feature in campaigns. They’re not passive capital—they’re enthusiastic collaborators.

总结来说:Z世代富豪投资的是文化价值,而不是数字收益。他们愿意把钱投在“没那么挣钱、但很酷”的东西上,因为在他们的金融字典里,“有态度”就是一种回报。而当越来越多富豪开始这样定义投资,“什么叫值钱”这件事,可能也会随之改写。

In short: Gen Z is investing in cultural value, not just financial value. They’ll fund things that aren’t wildly profitable—if they’re culturally powerful. In their world, attitude is a form of return. As this philosophy grows, the definition of “what’s valuable” may be rewritten.

◆ ◆ ◆ ◆

我们能从年轻富豪的选择中学到什么?

What Can We Learn from Gen Z Billionaires?

◆ ◆ ◆ ◆

说到底,年轻富豪配置资产的方式,和我们认知中的“投资”确实有很大不同。他们不追涨跌,不迷信权威,不怕另类,反而更敢把钱投在那些代表自己、能说点什么的地方。

Let’s face it—the way young billionaires allocate wealth is radically different from how most people think about investing. They don’t chase short-term trends. They don’t blindly follow authority. They’re not afraid of being unconventional. Most importantly, they invest in things that feel like them.

这并不是他们“不在乎赚钱”,而是他们相信:只有贴合价值观的投资,才值得长期持有。这一套新逻辑,哪怕对普通人来说,也值得认真思考:

That doesn’t mean they don’t care about money—it means they believe that only value-aligned investments are worth long-term commitment. Even for ordinary investors, this philosophy has real wisdom.

1. 投资不能只是“收益导向”,更该“内在一致”

别再只看回报率,也要问问自己:你投资的东西,与你的生活方式一致吗?你真的理解它在做什么吗?它是不是能代表你想成为的样子?

2. 买资产,不如说是在选“你认同的未来”

年轻富豪投环保、艺术、心理健康,是因为他们关心这个世界怎么走;你也可以用自己的方式去支持你认同的事情,哪怕金额不大——一只基金、一家小众品牌、一个公益项目,都是在投你相信的未来。

3. “资产配置”不是冰冷工具,而是“生活构建术”

Z世代的资产布局,其实是在构建一种完整的生活图景:可以是葡萄园和酒文化的结合、也可以是艺术品和家族传承的融合,甚至是投资某个社区、圈层、平台,去定义自己的身份标签。这提醒我们:资产可以“很感性”,而感性选择未必不理性。

1. Investing Shouldn’t Just Be About ROI—It Should Be Internally Aligned

Stop only checking returns. Ask yourself: Does this investment fit your lifestyle? Do you understand what it stands for? Does it reflect who you want to become?

2. Buying an Asset Is Choosing the Future You Want to Support

Gen Z billionaires invest in sustainability, art, and mental wellness because they care about where the world is headed. You can do the same, even with smaller means. A niche brand, a themed fund, a social project—they’re all ways of saying, “This is the future I believe in.”

3. Asset Allocation Is Not a Cold Tool—It’s a Framework for Building a Life

Their portfolios reflect more than returns—they express identity, intention, and belonging. Whether it’s a vineyard, a startup, or an artist collective, Gen Z is showing us: emotionally meaningful investing can be deeply rational.

所以,别再觉得“投资很遥远、很高冷”。真正有钱的人,早就开始用钱过想要的人生了。而你我,也完全可以从这一代富豪身上,学会:什么是“有态度地配置”,什么是“自洽地赚钱”。

So don’t think of investing as distant or elitist. The truly wealthy are already using capital to live the lives they envision. You can too.

财富的方向,早就不只在银行账户里,而在你每天的选择里。

Because the direction of your wealth isn’t just in your bank account—it’s in the decisions you make every day.