2025 Wealth Report Insights: How to Build Your Own Wealth Amid Global Turbulence?

2025年,全球财富的变局已经悄然启动——而今年的《莱坊财富报告》更是为我们呈现了一张全球富人新的投资蓝图。无论你是处于财富积累的初期,还是正在思考如何实现财务自由,今年这份报告都值得你用心读一读。

As we step into 2025, the tectonic plates of global wealth are shifting—and the latest Knight Frank Wealth Report paints a new investment map for the world’s elite. Whether you’re just starting to build wealth or aiming to achieve financial freedom, this year’s report offers insights too valuable to miss.

我们不再只是“旁观者”。随着经济结构的变化、地缘政治的风云变幻,财富的流向已经悄悄发生了翻天覆地的变化。对于每个收入群体的人来说,不关注这些变化,不了解这些趋势,未来的财富可能就会错失重要机会。

We’re no longer just spectators. As economic structures evolve and geopolitical winds swirl, the flow of capital is undergoing a silent revolution. For every income bracket, failing to grasp these changes means risking the loss of future opportunities.

今年,《莱坊财富报告》以更为清晰的结构和更深入的数据,为我们呈现了五个必看主题。这些内容不仅关乎富人阶层的投资逻辑,更是每个人应当学习的财富积累方式。

This year's report brings clarity through structure and depth through data, highlighting five key themes you need to know. While rooted in the decisions of the ultra-wealthy, these insights provide lessons that every aspiring wealth builder can learn from.

◆ ◆ ◆ ◆

富人全球资产布局:财富迁徙中的“金钥匙”

Global Asset Allocation of the Wealthy:

The Golden Key in the Migration of Wealth

◆ ◆ ◆ ◆

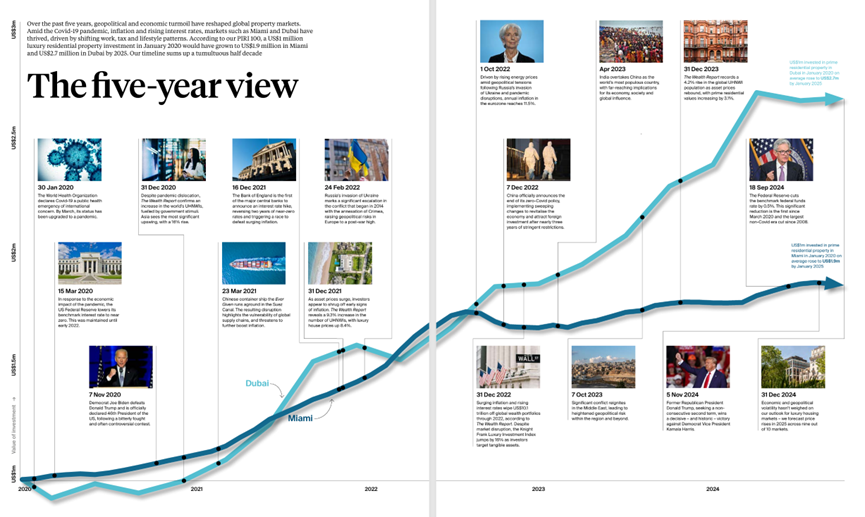

财富五年大复盘:疫情、战争如何改写房地产格局?

“Five Years of Wealth Shifts: How the Pandemic and Wars Reshaped Real Estate”

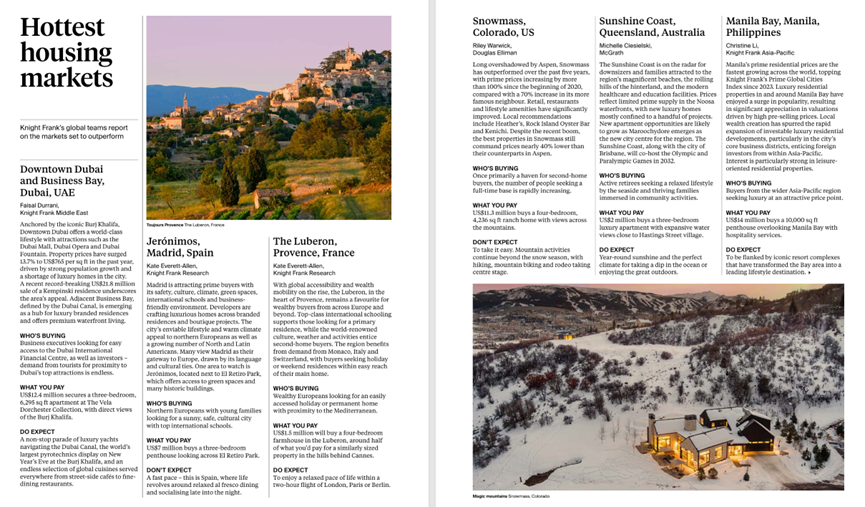

在过去的五年里,富人们的资产布局发生了根本性变化。从迈阿密、迪拜到伦敦,全球各大城市的房地产成了富人资金流动的核心。房地产不再是简单的投资工具,它已成为富人家族财富的根基。

Over the past five years, the asset allocation strategies of the wealthy have transformed radically. From Miami and Dubai to London, real estate has emerged as the gravitational center of capital. It’s no longer merely an investment—it’s the bedrock of family wealth.

面对动荡不安的全球局势,富人正在选择拥有“稳定性”和“抗风险能力”的核心资产。在这篇文章里,我们解读了富人如何利用房地产为自己的财富保驾护航,并总结出适合我们每个人的“稳健资产配置”理念。

Amid rising global uncertainty, the affluent are anchoring their portfolios with “core assets” that offer stability and risk mitigation. This section unpacks how real estate has become their ultimate shield and how you, too, can adopt a mindset of resilient asset allocation.

◆ ◆ ◆ ◆

财富增长的秘密:富人都去哪儿了?

The Secret to Wealth Growth: Where Are the Rich Headed?

◆ ◆ ◆ ◆

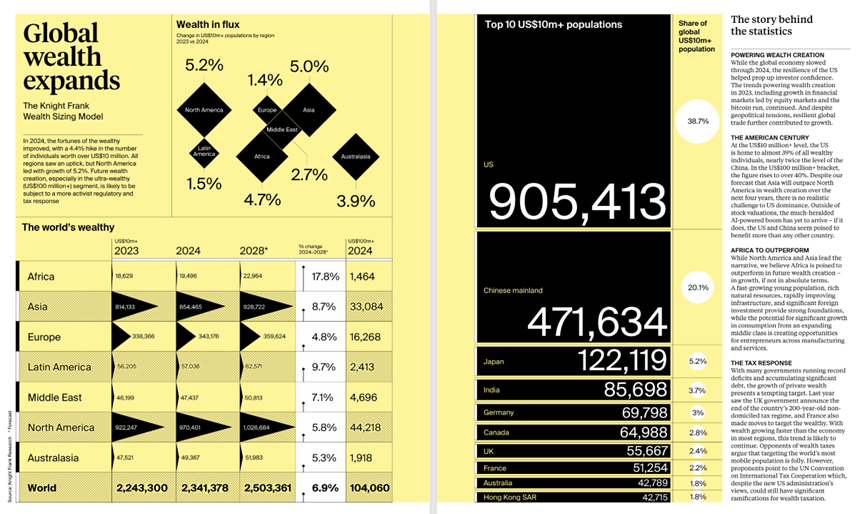

“有钱人都在哪?全球超级富豪地图曝光”

“Where Are the Wealthy? A Global Map of Emerging Billionaire Hubs”

全球富人群体的变化不容忽视。美国依然是全球富豪的首选地,但亚洲、尤其是中国和印度的崛起,正在重塑财富格局。

The composition of the global wealthy is shifting rapidly. While the U.S. remains the prime destination for high-net-worth individuals, the rise of Asia—particularly China and India—is redrawing the wealth landscape.

年轻一代的富人并不仅仅停留在传统的欧美市场,而是更为全球化,他们投资的地点和领域也正发生着深刻变化。在这篇文章中,我们探讨了全球财富的迁徙趋势,告诉你那些正在崛起的新富人聚集地,及其背后的财富逻辑。对于每个想要加速财富积累的普通人来说,提前了解这些市场,或许能为你的财富增长开辟新天地。

Today’s younger billionaires aren’t limiting themselves to traditional Western markets. Their investments are global, bold, and diversified across sectors and regions. In this section, we reveal the rising hotspots of global wealth and the logic behind them—insights that could help everyday investors identify the next big opportunity.

◆ ◆ ◆ ◆

年轻富豪的“另类”投资方式:

你也可以跟上他们的脚步

How Young Billionaires Invest: Follow Their “Alternative” Path

◆ ◆ ◆ ◆

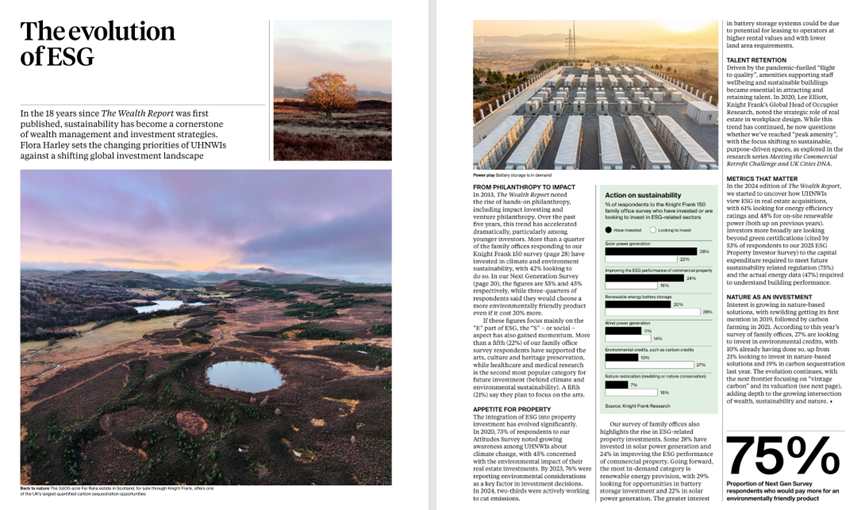

“年轻富豪怎么玩资产配置?”

“What the Next Generation of Wealth Is Doing Differently”

与上一代富人不同,Z世代富豪正通过更加多元、个性化的方式来配置自己的财富。环保、绿色投资、可持续发展,成为他们投资的新方向。葡萄园、艺术品、精品酒店等“非传统资产”也成为他们的重要选择。

Unlike previous generations, Gen Z billionaires are building wealth on their own terms—with purpose and personality. Their portfolios are a blend of profit and principle, focused on sustainability, green innovation, and ethical investing.

这些年轻的富豪并不仅仅关心回报率,而是关注投资背后的价值观表达,推动了金融与文化的深度结合。在这篇文章中,我们深入解析了年轻富豪如何通过“有态度”的资产配置来实现财富增长,给你带来更多资产布局的灵感。

From vineyards and art collections to boutique hotels and impact funds, they’re moving beyond traditional asset classes. This section dives into how young tycoons are using value-driven investments to express their beliefs and generate long-term returns. Their bold new strategies could inspire your next financial move.

◆ ◆ ◆ ◆

富人为什么爱房地产?他们买的,不止是房子

Why the Wealthy Still Bet on Real Estate:

More Than Just Bricks and Mortar

◆ ◆ ◆ ◆

“富豪们在买什么?为什么他们最爱房地产?”

“What Are the Ultra-Rich Really Buying—and Why Real Estate Is Still Their Crown Jewel”

对于许多人来说,买房仅仅是满足居住需求,而对于富人来说,房产不仅仅是住所,更是财富的“堡垒”。富人通过房地产实现资产的传承与保值,从豪宅到商业地产,再到长租公寓和酒庄,房产的类型在富人资产中多样化,且趋于稳健。

For most, property means shelter. But for the wealthy, it’s power, preservation, and permanence. Real estate—whether luxury homes, commercial buildings, long-term rental assets, or vineyards—remains the cornerstone of generational wealth.

这篇文章,揭示了富人为什么不止关注回报,而是更加注重资产背后的控制权与长远规划。无论你处在哪个收入阶层,房地产都是你财富积累的重要工具,了解富人如何在房地产上布局,能为你带来更多的投资启示。

In this section, we reveal why the rich favor assets that grant control, stability, and legacy value. It’s not just about returns—it’s about long-term influence. Regardless of your income level, understanding how the wealthy play the real estate game can reshape your own investment mindset.

◆ ◆ ◆ ◆

我们如何在风云变幻中生存并繁荣?

How to Thrive Amid Global Risks

◆ ◆ ◆ ◆

“2025全球风险图鉴:哪些变量可能引爆财富地震?”

“2025 Risk Map: Which Shocks Could Trigger the Next Wealth Earthquake?”

随着地缘政治紧张、经济滞涨、科技泡沫等多重风险的叠加,富人们的财富管理更加趋向保守与多元化。他们早已开始为“潜在的财富地震”做好准备,布局避险资产、调整财富结构。对于普通人而言,这种风险意识同样至关重要。通过这篇文章,我们帮助你分析了全球经济的潜在风险,教你如何借鉴富人的应对策略,为自己打下稳固的财富根基。

As geopolitical tensions, economic stagnation, and tech bubbles converge, the wealthy are shifting toward more conservative and diversified wealth management strategies. They've already started preparing for potential “wealth quakes” by investing in safe-haven assets and adjusting their financial structures. Ordinary people, too, need to develop this risk-awareness. In this section, we analyze potential global risks and share how the wealthy are preparing—helping you lay a more secure foundation for your own financial future.

◆ ◆ ◆ ◆

让财富更自由,给未来加码

Let Your Wealth Move Freely. Build a Future That Lasts

◆ ◆ ◆ ◆

识别大风险时代的生存法则:

普通人的底层保护逻辑

How Ordinary People Can Navigate a High-Risk Era:

Survival Strategies for 2025

2025年的《莱坊财富报告》为我们提供了富人资产配置的全面解读,无论你是刚刚踏上财富积累之路,还是已经拥有一定资产的投资者,都不容忽视这些富人的行动。

The 2025 Knight Frank Wealth Report offers not just a look into how the rich invest—but a masterclass in financial resilience. Whether you’re just getting started or refining an existing strategy, these insights offer a roadmap for smarter, more strategic wealth building.

今天的财富世界,不再是单纯的“赚多少钱”——而是如何以更加智慧和多元化的方式,布局未来的财富体系。我们可以从富人的投资决策中学到如何更好地保护自己的资产,如何在动荡的市场中为自己保留弹性。从地产到艺术,从股市到科技,财富的积累不再是“快餐式”的选择,而是一次次深思熟虑的战略布局。

In today’s world, wealth isn’t only about how much you earn—it’s about how wisely and flexibly you allocate it. From real estate and fine art to equities and tech, wealth accumulation is no longer about speed—it’s about foresight and intention.

让我们一起从这些富人行动中汲取智慧,早日实现财务自由,迈向更稳定、更有质量的未来。

Let’s learn from the bold, deliberate moves of the wealthy and take steps today that position us for a more secure, free, and high-quality tomorrow.

你想了解更多富人投资背后的智慧吗?点击链接进入对应文章,解锁更多财富增长的秘密。

Curious about the strategies behind how the wealthy grow their fortunes? Click through to read each deep dive article and unlock the blueprint to smarter investing.