Why Are They Giving Up on the U.S. and Singapore? These 4 Destinations Are Now the Top Picks for Wealthy Chinese

◆ ◆ ◆ ◆

中国富人“弃美弃新”,泰国成为新宠

Chinese Tycoons Turn Away from the U.S. and Singapore

Thailand Emerges as a New Favorite

◆ ◆ ◆ ◆

曾几何时,美国和新加坡是中国富人海外置业时绕不开的两大热门国家。前者象征着稳定与全球地位,后者则以便利的地理位置与华人文化吸引力著称。但到了2024年,风向悄然转变。越来越多的高净值买家开始“主动降温”对美、新的兴趣,而泰国却一跃成为他们首选的置业新贵。

There was a time when the United States and Singapore were the go-to countries for Chinese investors looking to purchase overseas properties. The former represented stability and global prestige, while the latter attracted buyers with its proximity to China and strong cultural ties to the Chinese diaspora. But by 2024, the trend is shifting. Increasingly, high-net-worth Chinese buyers are deliberately cooling on the U.S. and Singapore—and turning their focus to Thailand as a rising star in real estate.

这一转变背后并非偶然。数据显示,过去一年,中国高净值人群在价值500万美元以上房产的购买兴趣中,美国的排名已滑落至第七,新加坡也从前年的第三名跌至第九。与此同时,泰国则登顶热度榜首,成为中国人高端房产询价最多的国家。显然,那些拥有强大资金能力的人,并不是被动跟风,而是做出了一种全新的、主动的资产选择——他们不再为移民而买房,而是为了“更好地过生活”。

This shift is no coincidence. Data shows that in the past year, interest among wealthy Chinese buyers in properties worth over $5 million has seen the U.S. fall to seventh place, while Singapore has dropped from third to ninth. Meanwhile, Thailand has soared to the top of the list, becoming the most inquired-about country for high-end Chinese real estate. It’s clear: these affluent individuals aren’t simply following trends—they are making conscious, strategic asset choices. They are no longer buying homes for immigration, but to enhance their quality of life.

◆ ◆ ◆ ◆

身份不再是买房首因,他们要“能用”的资产

Property for Use, Not for Status: A Shift in Buying Motivations

◆ ◆ ◆ ◆

曾经,海外房产是中国富人实现“身份跃迁”的快捷通道。黄金签证、绿卡、护照,配合一套房产,不仅让资金出海顺理成章,也附带了一份“全球通行证”。但如今,这一逻辑正在被彻底重写。

In the past, owning overseas property served as a shortcut for Chinese elites to gain foreign residency or citizenship. Golden visas, green cards, and passports bundled with a piece of real estate allowed for capital to flow overseas smoothly, while also securing a kind of “global access pass.” Today, that logic is being rewritten.

数据显示,2023年,仅有3%的中国买家是为了移民而购置海外房产,而在2019年,这个比例还高达11%。取而代之的,是“自己或家人会真正使用”的住房需求——超过九成的买家都在寻找能满足家庭实际生活的住宅,无论是孩子留学的学生公寓,父母旅居的度假屋,还是全家短居时的生活据点。

In 2023, only 3% of Chinese buyers purchased overseas properties for immigration purposes, compared to 11% in 2019. Instead, the overwhelming majority—over 90%—are looking for homes they or their families can actually use, whether that means student apartments for their children studying abroad, vacation homes for their parents, or short-stay bases for the whole family.

富人们越来越明白,与其追逐抽象的身份标签,不如选择那些能切实改善生活质量、提升家庭幸福感的“生活方式型资产”。这类资产并不以升值为首要目标,而是强调空间舒适度、地段便利性和功能匹配性。对他们而言,买房不再是一种身份象征,而是一种生活工具。

These buyers have come to understand that rather than chasing abstract status markers, it makes more sense to invest in lifestyle assets—properties that improve quality of life and bring genuine happiness to the family. These aren’t necessarily purchased for appreciation potential, but for comfort, convenience, and practical functionality. For them, a home is no longer a symbol of identity, but a tool for living well.

◆ ◆ ◆ ◆

泰国、澳洲、加拿大、马来西亚:财富新流向

Thailand, Australia, Canada, Malaysia: The New Map of Wealth

◆ ◆ ◆ ◆

如果说前几年,中国富人的海外买房地图还集中在美、英、新这样的传统强国,那么如今,新一线买房热土正在悄然崛起。泰国、澳洲、加拿大、马来西亚,这四个国家,正逐渐接住了从欧美转移而来的中国资金流。

A few years ago, Chinese buyers concentrated their purchases in Western powerhouses like the U.S., U.K., and Singapore. But now, new hotspots are emerging quietly. Thailand, Australia, Canada, and Malaysia are becoming the top destinations for Chinese capital.

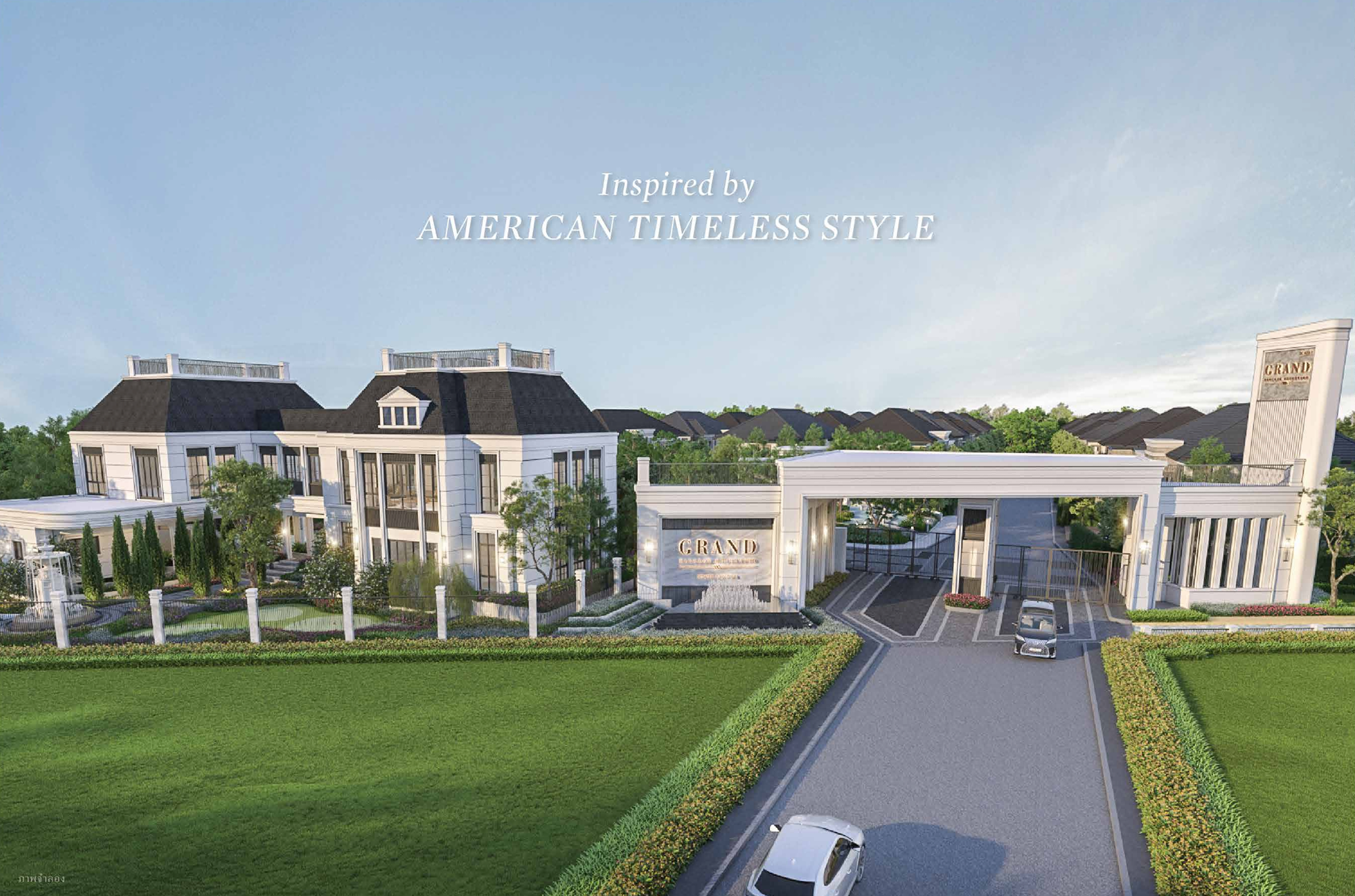

泰国以其相对友好的政策、物美价廉的高端住宅和日益国际化的生活方式成为榜首,不仅吸引了长居者,也赢得了希望常来短住富人家庭的青睐。而澳洲则凭借其稳定的社会环境和顶尖的教育资源,继续保持在榜单前列。2024年,澳洲跃升至中国买家关注度的第二名,仅次于泰国。

Thailand leads the way with its friendly policies, high-quality yet affordable luxury homes, and an increasingly globalized lifestyle. It appeals not only to long-term residents but also to affluent families who wish to visit frequently. Australia continues to rank high thanks to its social stability and top-tier education system—by 2024, it has risen to the second spot among Chinese buyers, right behind Thailand.

加拿大和马来西亚,则各有独到之处。前者依然稳固着“传统安全牌”的位置,而后者则以“高性价比+国际教育+放宽签证”的组合拳,在近两年实现了黑马式突破。

Canada and Malaysia each offer unique advantages. Canada remains a reliable “safe bet,” while Malaysia is quickly gaining momentum through a combination of value for money, international education options, and relaxed visa rules. This “dark horse” has seen a significant rise in popularity over the last two years.

资产的流向从来不是随机发生的,中国富人正在用脚投票,重新绘制属于他们的全球生活地图。

The flow of capital is never random. Chinese elites are voting with their wallets, redrawing their own global map for better living.

◆ ◆ ◆ ◆

黄金签证退出舞台,投资动因彻底改写

The Demise of Golden Visas: A New Investment Narrative

◆ ◆ ◆ ◆

曾经,大批中国富人选择海外购房,不仅是为了多一个“落脚点”,更是为了拿到一张“身份牌”。这背后的关键,是各国与房地产绑定的黄金签证政策。但这条捷径,正在被悄然封堵。

For many years, Chinese investors viewed foreign real estate not just as an investment, but as a ticket to a new identity. Real estate-linked golden visa programs made this possible. But this pathway is quietly being shut down.

过去几年,包括西班牙、爱尔兰等多个国家陆续叫停了黄金签证计划——前者曾允许外国人通过购买50万欧元房产换取居留权,后者则以200万欧元的房地产信托投资作为门槛吸引全球资金。而这些政策,正是过去十年间推动中国资本出海的重要驱动力之一。仅西班牙一国,就为中国买家发放了超过11,000份此类签证。

Countries like Spain and Ireland have recently scrapped their golden visa programs—Spain once offered residency in exchange for a €500,000 property purchase, while Ireland required a €2 million real estate trust investment. These policies were among the main drivers behind the outbound flow of Chinese capital over the past decade. Spain alone issued over 11,000 such visas to Chinese nationals.

如今,这扇门逐步关闭。原本打算“房产换身份”的高净值人士开始重新审视海外买房的意义。不再追逐护照和绿卡,而是更关注“这套房子到底能为我和家人带来什么”。

Now, that door is closing. High-net-worth individuals who once hoped to trade homes for citizenship are reevaluating what buying abroad truly means. No longer chasing passports and green cards, they are instead asking: What can this property really do for me and my family?

政策退场之下,中国富人的投资动因正从“身份导向”转向“生活导向”,而这场悄无声息的切换,正在彻底改变全球房地产版图上的重心。

With policy incentives fading, Chinese investors are shifting from an identity-driven mindset to a lifestyle-focused one—quietly but fundamentally reshaping the global real estate landscape.

◆ ◆ ◆ ◆

房产 = 生活平台?

富人眼里的“资产温度”正在上升

Real Estate as a Lifestyle Platform:

The Rising "Warmth" of Property Assets

◆ ◆ ◆ ◆

对中国的富裕人群而言,海外房产正逐渐从一项“冷冰冰的投资”变成一个“真正用得上的空间”。换句话说,他们不再只是买房,而是在选择一种生活的延伸方式。

To China’s wealthy class, foreign real estate is evolving from a “cold investment” into a “space they can truly use.” In other words, they’re not just buying houses—they’re buying an extension of their lifestyle.

他们关心的不再是每年的租金收益率,而是房子离哪所国际学校近、生活配套是否便利、社区氛围是否友好。尤其是像马来西亚这样生活成本低、华人文化浓、国际教育资源丰富的国家,正悄然赢得他们的青睐——无论是用于子女留学过渡,还是为年长父母打造“第二居所”,这种“住得舒服、花得理性”的房产,才是他们现在真正想要的。

They care less about rental yields and more about proximity to international schools, the quality of surrounding amenities, and whether the neighborhood feels welcoming. Countries like Malaysia, with its low cost of living, strong Chinese cultural presence, and growing international education sector, are increasingly attractive. Whether for kids studying abroad or aging parents in need of a second home, these “comfortable, sensible” properties are exactly what they’re looking for.

以马来西亚为例,从吉隆坡到新山再到槟城,一批又一批新社区围绕国际学校悄然兴起,加上“马来西亚我的第二家园”政策的优化,正在重构那群人对“家”的定义。而在价格方面,相较新加坡动辄每平方英尺1800美元,马来西亚高端住宅的均价仅为240美元——同样是国际城市级别的生活质感,却只需付出不到两成的成本。

Take Malaysia, for example. From Kuala Lumpur to Johor Bahru to Penang, new communities are springing up around international schools. And with ongoing enhancements to the Malaysia My Second Home (MM2H) program, the idea of “home” is being redefined for many Chinese families. In terms of cost, while Singapore’s luxury apartments can cost upwards of $1,800 per square foot, similar-quality homes in Malaysia average just $240 per square foot—offering international-city living at less than 20% of the cost.

这一代中国富人,正在用自己的方式告诉市场:资产的价值不止在账面,更在生活能否真正被照顾到。

This generation of wealthy Chinese is sending a clear message to the market: the true value of an asset lies not just in numbers, but in the life it enables.