Expensive Doesn’t Equal Profitable: 5 Thai Rental Markets That Are Quietly Booming

◆ ◆ ◆ ◆

租房热成新风口?

Is Renting the New Investment Frontier?

◆ ◆ ◆ ◆

过去大家讨论曼谷房产,大多聚焦在“买”——买哪里升值快,买哪栋才保值。但2025年刚开年,一条新闻却让很多中国投资客有点动摇了:有些人,居然每月花25万泰铢租一套公寓。

For years, talk of Bangkok real estate revolved around one word: buying. Where to buy for fast appreciation? Which building held value best? But as 2025 unfolds, a surprising headline has shaken up Chinese investors: some people are now paying 250,000 baht a month—not to own, but to rent an apartment.

是的,不是买,是租。比有些人年收入还高的租金,正在悄悄把“租房”推向风口。而与此同时,另一个现实也摆在面前——这些高价租房背后的投资回报,并没有你想的那么惊艳。不少人算了一圈账,反而发现中端公寓才是真正赚钱的“香饽饽”。

Yes, renting. At a price higher than many annual salaries, luxury rentals are emerging as a new market trend. But here’s the kicker—the returns on these properties are not nearly as dazzling as expected. After some simple calculations, savvy investors are realizing that modest, mid-tier condos may be the real goldmine.

租金涨得快,回报却慢下来,这让人不得不重新审视一个问题:如今在泰国投公寓,还值得吗?又该怎么选,才能避坑、赚钱两不误?

As rents surge but ROI slows, the question looms: is investing in Thai condos still worth it? And if so, how can you choose wisely—avoiding traps while securing stable returns?

◆ ◆ ◆ ◆

谁在花25万租房?

Who’s Paying a Quarter-Million in Rent?

◆ ◆ ◆ ◆

说实话,很多人第一反应是:谁会每月掏25万泰铢去租房?疯了吗?但真不是玩笑。根据泰国ProSpec的市场调研,2025年曼谷已经有不少高端地段公寓,租金冲上了每月20-25万泰铢的级别,而且这些房子,还真不是空着等人,是被“高净值租户”牢牢锁定的。

The immediate reaction from many: Who in their right mind would drop 250,000 baht a month on rent? But this isn’t fiction. ProSpec research reveals that luxury condos in prime Bangkok neighborhoods are indeed commanding such rents—and they’re not sitting vacant.

这些租户多半是外企高管、跨国公司派驻人员,或者在泰国本地发展的外国富裕家庭。他们在意的是地段、安全、配套和生活便利度。尤其像 Charoen Krung、Langsuan、Radio Road 一带,既临近核心商业圈,又能享受高端生活资源,这类“地段控”租户,愿意为生活质量买单。

The tenants? Mostly expat executives, foreign professionals on assignment, or wealthy international families. Their top concerns? Location, safety, amenities, and a seamless lifestyle. That’s why areas like Charoen Krung, Langsuan, and Radio Road—close to business hubs yet offering high-end comforts—are in high demand.

但投资人也别太兴奋太早。因为你可能要花上数千万泰铢才能买下一套这样的公寓,租金虽高,年化收益却只有3%-5%。算下来,不如一套租金不到2万泰铢的中端房赚得多。

Still, investors should curb their enthusiasm. These prime condos can cost tens of millions of baht, and while rents are high, returns often hover at just 3–5% annually. Meanwhile, a mid-range unit renting for under 20,000 baht can generate more attractive yields.

◆ ◆ ◆ ◆

最赚钱的不是最贵的

Profit Isn’t Where It’s Flashiest

◆ ◆ ◆ ◆

一边是月租二三十万的豪宅看起来风光无限,另一边却是投资人悄悄转向那些月租只要一万多的“小户型”。这背后的逻辑,其实就一个字:算。

On one side are glamorous condos renting for 200K+ per month. On the other, smaller units quietly raking in solid profits. The reason is simple: smart math.

拿市场最新的数据来看,那些标价在1500万泰铢以上的高端公寓,租出去月租最多也就20万到25万之间,年化收益率通常在3%-5%左右。而中端市场呢?售价200万到300万泰铢的公寓,租金每月1.2万到1.8万不等,年化收益率轻松破5%,甚至能摸到7%的边。

High-end condos priced over 15 million baht may fetch high rents, but the annual yield typically stalls at 3–5%. Meanwhile, units priced between 2–3 million baht, with monthly rents of 12,000–18,000 baht, can generate returns upwards of 5–7%.

而且,中端市场的“出货”速度也更快。租户多是本地白领、外籍教师、远程办公的数字游民,租期稳定、周转率高,不像高端公寓那么挑人、空置周期长。

Even better, mid-range units rent faster and more frequently. The tenant pool—local professionals, international teachers, remote workers—is broad, stable, and mobile. Unlike luxury properties with long vacancy risks, mid-tier rentals stay busy.

这就像是买股票一样——高价蓝筹稳是稳,但波动少、起伏小;而那些优质中小盘,才是真正拉高收益的利器。

Think of it like the stock market: blue-chip investments are stable, but smaller high-quality assets often outperform.

所以现在,越来越多眼光敏锐的中国买家,已经开始从“看着贵就觉得值”这一思维里跳出来,转向“租得快、回得稳”的实战派投资逻辑。

That’s why more Chinese investors are stepping away from price-driven assumptions and leaning into performance-focused strategies: rentability, stability, and smart returns.

◆ ◆ ◆ ◆

中国买家别盲冲

Don’t Buy Blind—Think Beyond the BTS Line

◆ ◆ ◆ ◆

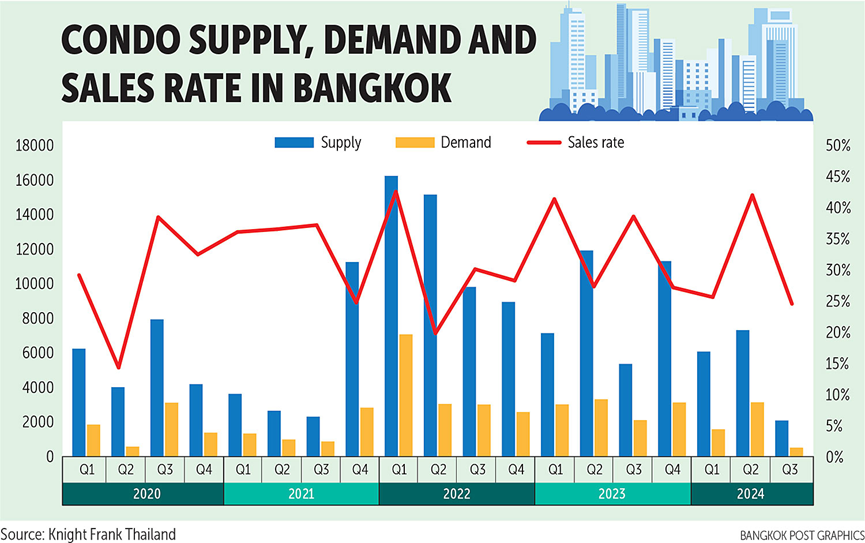

这些年,不少中国投资客一提到“买泰国房”,脑子里第一个浮现的就是:离BTS(轻轨)近不近?是不是核心CBD?租金能不能一炮而红?但现实情况是,盯着那些“标志性地段”的人太多了,竞争白热化,回报自然就稀释了。

For many Chinese buyers, the checklist sounds familiar: Is it near the BTS? In the CBD? Can rent double overnight? But overcrowded competition in these “iconic” zones is squeezing returns.

再加上土地成本、开发成本逐年上涨,许多新盘售价被抬得飞起,可租金涨幅却远没跟上节奏。这也就意味着,很多看起来“高大上”的项目,其实回本周期比想象中要长很多。

Meanwhile, land and construction costs keep rising, pushing sales prices skyward. Rental rates, however, haven’t kept pace—stretching out break-even periods.

尤其是一些没做太多功课、跟风买入的中国投资者,一开始就冲着“曼谷富人区”杀进去,结果发现不是空租期太长,就是租金根本达不到预期,等回过神来,已经被市场“教育”了一轮。

Too often, Chinese buyers rush into Bangkok’s “rich districts,” only to find long vacancies and underwhelming rental income. By the time the market corrects their expectations, the lesson is already paid for.

所以现在的关键不是“买在哪最贵”,而是要搞清楚:这个房子好不好租?租给谁?多久能回本?有没有真实的租客群在支撑这套投资逻辑。

Today, it’s not about “where’s most expensive”—it’s about: Will it rent? Who will rent it? When will you break even? Are real tenants out there?

别盲目追热,反而要选那些被忽略但刚需稳定、租金扎实的区域,才是真正适合长期持有、稳中求胜的打法。

Forget chasing the hype. The smartest move is to find overlooked areas with real demand, solid yields, and long-term growth potential.

◆ ◆ ◆ ◆

这些区域才值得你看

The Real Winners: Quiet Yet Promising Districts

◆ ◆ ◆ ◆

如果你不是奔着“炫资产”的目的,而是真心想靠租金回报打下一套现金流,那你该看的,可能不是Sathorn、Langsuan、Chidlom这些传统“富人地标”,而是那些低调但潜力十足的新兴区域。

If you are not looking to show off your assets but really want to build a cash flow through rental returns, then you may not want to look at traditional “rich landmarks” such as Sathorn, Langsuan, and Chidlom, but rather those low-key but promising emerging areas.

像是乍都乍(Chatuchak)、辉煌(Huay Khwang)、帕亚泰(Phaya Thai),这些地段虽然目前租金水平没那么惊人,但胜在租客基础稳,靠近大型办公区、教育机构、医院与地铁交汇点,居住需求常年稳定。

If your goal is cash flow—not bragging rights—look beyond Bangkok’s elite enclaves. Instead, explore emerging districts like Chatuchak, Huay Khwang, and Phaya Thai.

租金虽低,但入住率普遍能维持在75-85%左右,年化收益也能稳稳落在4%-6%区间。更重要的是,这些区域的购入门槛对大多数中国投资者更友好,少了豪宅区动辄千万的压力,腾出了更灵活的资金空间。

These neighborhoods may lack luxury glitz, but their fundamentals are strong: near offices, schools, hospitals, and transit hubs. Demand is steady, occupancy rates hit 75–85%, and returns hover at a respectable 4–6%. Best of all, entry prices are far more accessible—giving investors breathing room and flexibility.

当然,投资不是拍脑袋决定的事。看位置、看产品、看人群都重要,但归根到底是要“以租养房”,别让自己在高租金幻想里迷了路。

In the end, real estate is about people. Who’s living there? What do they need? If rent can cover your costs and yield steady income, that’s a winning strategy.

现在的曼谷,不缺贵房子,缺的是聪明的投资视角。

In Bangkok today, there’s no shortage of expensive properties—only a shortage of smart investors.