EEC政策把罗勇推上风口:Atmoz Canvas Rayong 用“4%包租+3年托管”提前锁死现金流

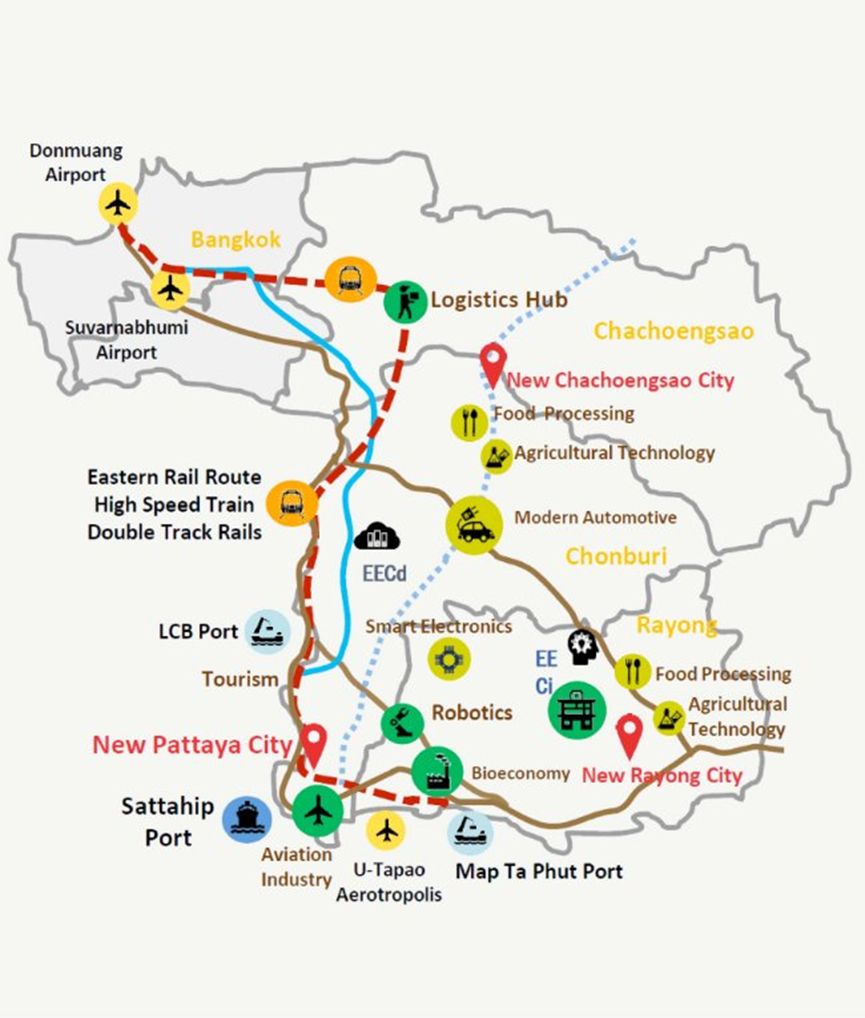

很多人理解EEC,还停留在“工业园多、工厂多”的层面,但真正决定投资价值的,从来不是厂房本身,而是资金为什么会持续往这里流。EEC东部经济走廊是泰国国家级战略,背后对应的是产业转移、制造升级和长期基础设施投入,高速公路、港口、铁路同步推进,本质是在为资本铺路。

Many people still understand the EEC only at the level of “many industrial parks and factories.” But what truly determines investment value has never been the factories themselves—it is why capital continues to flow here. The Eastern Economic Corridor (EEC) is a national-level strategy of Thailand, driven by industrial relocation, manufacturing upgrades, and long-term infrastructure investment. Highways, ports, and railways are being developed simultaneously. In essence, this is about paving the way for capital.

罗勇正好站在这条通道的核心位置,从传统工业城市,被一步步推向承接产业资金、人口和居住需求的前沿节点。当一个城市开始同时吸引工厂、人才和配套投入时,它的角色就不再只是“生产地”,而是正在转变为一个真正的资金入口。

Rayong sits at the core of this corridor. It is being gradually transformed from a traditional industrial city into a front-line hub for industrial capital, population inflows, and residential demand. When a city begins attracting factories, talent, and supporting investments at the same time, it is no longer just a “production base,” but is evolving into a true gateway for capital.

◆ ◆ ◆ ◆

人口即租金:产业落地后的需求

Population Equals Rent: Demand After Industrial Entry

◆ ◆ ◆ ◆

投资房产,最终看的不是城市宣传片,而是人住不住、租不租、能租多久。EEC政策落地后,罗勇最先发生变化的,并不是房价,而是人口结构。大量中资制造企业在这里建厂投产,从一线工人到技术骨干,再到外派管理层,都是以“年”为单位驻扎的长期人群。

When investing in property, what ultimately matters is not promotional videos, but whether people actually live there, rent there, and stay long term. After the implementation of EEC policies, the first change in Rayong was not housing prices, but population structure. A large number of Chinese-funded manufacturing enterprises have set up factories here. From frontline workers to technical staff and expatriate managers, these are long-term residents who stay for years.

这类人对住房的需求非常明确:离工业园通勤可控、生活配套成熟、居住品质过得去。问题在于,罗勇过去的住宅供给,大多停留在本地自住或员工宿舍层级,高质量、可长期出租的公寓本身就不多。于是,一个很直接的结果出现了——人先到位,租金自然就被顶了起来。在这种结构下,租金并不是靠炒出来的,而是被真实需求一点点“推”出来的。

Their housing needs are very clear: reasonable commuting distance to industrial parks, mature living facilities, and acceptable living quality. However, Rayong’s past housing supply mainly focused on local owner-occupied homes or employee dormitories. High-quality apartments suitable for long-term rental were limited. As a result, a very direct outcome emerged—people arrived first, and rents were naturally pushed up. In this structure, rents are not driven by speculation, but by real demand pushing them upward step by step.

◆ ◆ ◆ ◆

为什么把房子分成两条路

Why Divides Its Units into Two Paths

◆ ◆ ◆ ◆

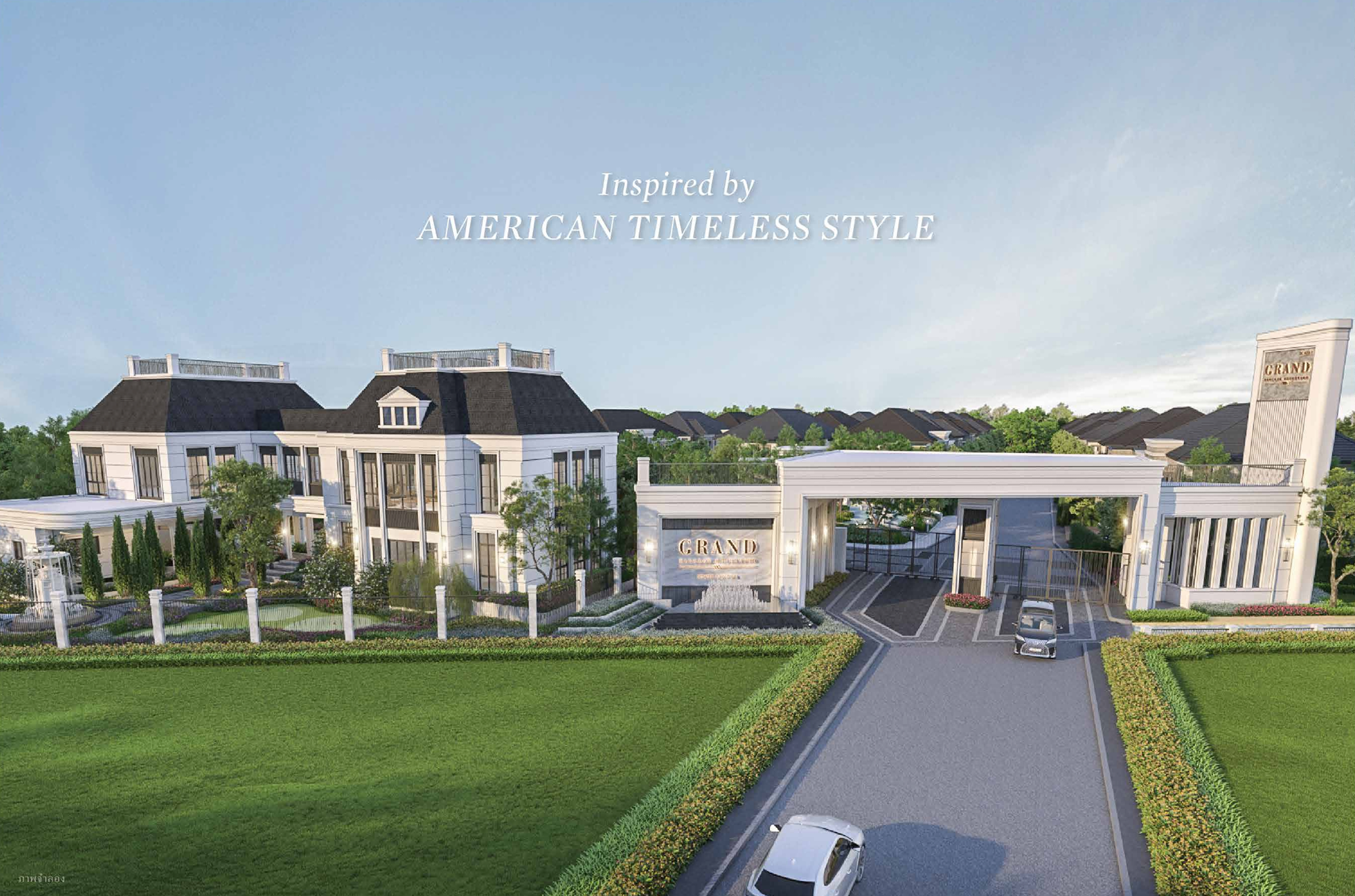

同样是在罗勇市中心,同一个项目里,Atmoz Canvas Rayong 并没有把所有房源都当成“一个产品”来卖,而是很清晰地分成了两种用途。B 栋更偏向自住,给的是灵活优惠,强调居住选择权;而 A/C 栋一开始就被定义为 Investment Units,也就是标准化的投资型房源。

Even within the same project in central Rayong, Atmoz Canvas Rayong does not treat all units as one single product. Instead, it clearly divides them into two different uses. Building B is oriented toward owner-occupiers, offering flexible incentives and emphasizing residential choice. Buildings A and C, however, were defined from the beginning as Investment Units—standardized units designed specifically for investment.

这个区别很关键,因为它直接决定了房子是围绕“住得舒服”设计,还是围绕“怎么稳定收租”来设计。对于投资者来说,真正有价值的并不是房子本身,而是这套资产在交付之后,有没有一条清晰、可执行的收益路径。A/C 栋从产品定位阶段,就已经把这条路径提前规划好了。

This distinction is crucial because it determines whether a property is designed around “comfortable living” or around “stable rental income.” For investors, what truly matters is not the unit itself, but whether there is a clear and executable income path after handover. Buildings A and C have already planned this path at the product positioning stage.

◆ ◆ ◆ ◆

包租不是噱头

Guaranteed Rent Is Not a Gimmick

◆ ◆ ◆ ◆

很多投资者一看到“4%包租”,第一反应往往是质疑:是不是羊毛出在羊身上?但放在 Atmoz Canvas Rayong 的 A/C 栋体系里,这个 4% 的意义,其实不在于“高不高”,而在于先把第一段现金流跑通。

When many investors see “4% guaranteed rent,” their first reaction is often skepticism—wondering whether the cost is hidden elsewhere. But within the A/C building system of Atmoz Canvas Rayong, the significance of this 4% lies not in how high it is, but in getting the first stage of cash flow running.

对于海外投资来说,最大的风险从来不是长期回报,而是前期空置、找租客、价格摸不准。首年4%包租,本质上是由项目方把这段最不确定的时间接过去,让房子在交付后直接进入“有收益状态”。投资者不需要经历试错期,也不用自己去验证市场水温,而是从第一年开始,就能清楚地看到:这套资产,是如何把“需求”转化成“现金”的。

For overseas investors, the biggest risk is not long-term returns, but early-stage vacancy, tenant sourcing, and price uncertainty. The first-year 4% guaranteed rent essentially means the developer absorbs this most uncertain period, allowing the unit to enter a “income-generating state” immediately upon handover. Investors do not need to go through a trial-and-error phase or test the market themselves. From the first year, they can clearly see how this asset converts “demand” into “cash.”

◆ ◆ ◆ ◆

强制托管:省心,更赚钱

Mandatory Management: Less Worry, Better Returns

◆ ◆ ◆ ◆

很多人对“强制托管”天然排斥,觉得限制了自由,但在海外投资里,真正拉开收益差距的,往往不是你会不会出租,而是你能不能把风险控制住。Atmoz Canvas Rayong 的 A/C 栋要求签署 3 年YOUDEE托管协议,并不是为了绑定客户,而是为了确保包租和后续出租能够顺利衔接。

Many people instinctively resist “mandatory management,” seeing it as a restriction on freedom. But in overseas property investment, what really differentiates returns is not whether you can rent out a unit, but whether you can control risks. The A/C buildings of Atmoz Canvas Rayong require a 3-year YOUDEE management agreement, not to bind clients, but to ensure a smooth transition between the guaranteed rent period and subsequent leasing.

托管内容覆盖找租客、租金回收、维修协调、清洁管理和账单提醒,这些看似琐碎的环节,恰恰是海外房东最容易出问题的地方。通过统一托管,项目把“个体房东的不确定性”,变成了“标准化运营的确定性”,让租金不依赖个人经验,而是依赖成熟机制去跑。

Management services cover tenant sourcing, rent collection, maintenance coordination, cleaning management, and bill reminders. These seemingly trivial details are exactly where overseas landlords encounter the most problems. Through unified management, the project turns the uncertainty of individual landlords into the certainty of standardized operations, making rental income depend on proven systems rather than personal experience.

◆ ◆ ◆ ◆

现金流路径:回报如何被看见

Cash Flow Path: How Returns Become Visible

◆ ◆ ◆ ◆

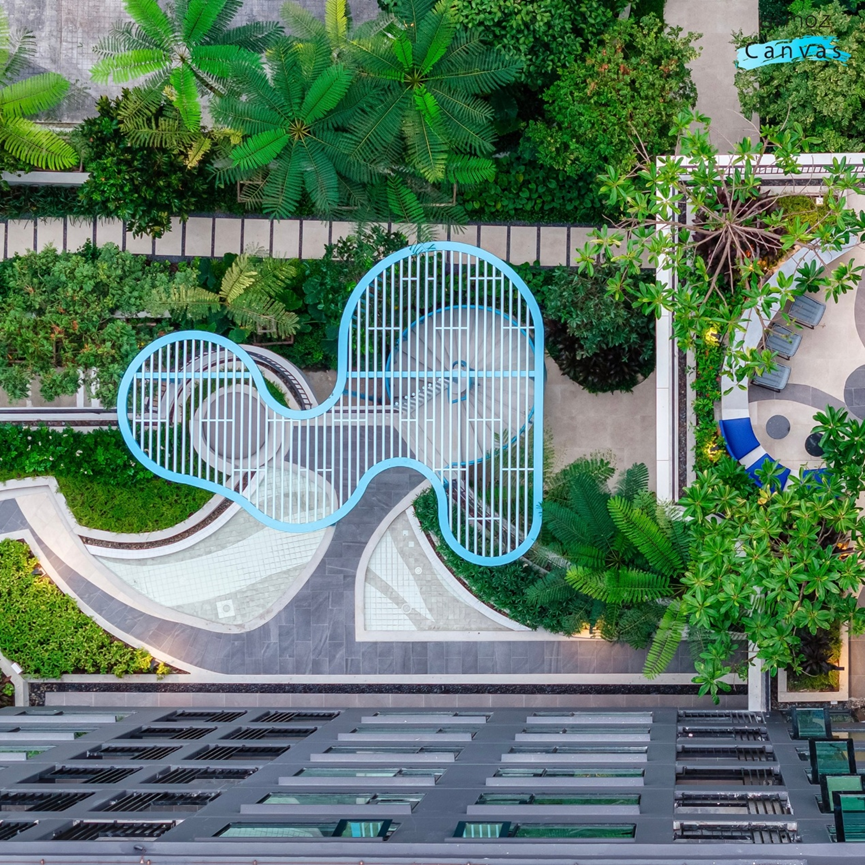

对投资者来说,回报不仅是数字,更是什么时候能拿到钱。A/C 栋在托管体系下,租金按季度发放,这个设计本身就很“投资导向”。相比一年一结,季度返租让现金流更频繁地回到账上,也更容易判断这套资产是否在正常运转。

For investors, returns are not just numbers—they are also about when cash is received. Under the managed system, rental income for A/C buildings is distributed quarterly, which is a very investment-oriented design. Compared with annual settlements, quarterly payments allow cash flow to return more frequently and make it easier to judge whether the asset is operating normally.

首年包租提供的是确定性,第二、三年按市场价格托管,则是把收益交回给真实租赁需求来决定。在产业人口持续流入的背景下,租金并不是一次性兑现的结果,而是一条可以持续滚动的现金流路径。对投资人来说,这种“看得见、摸得着、可持续”的回报节奏,本身就是安全感的一部分。

The first-year guaranteed rent provides certainty. In the second and third years, rent is managed at market rates, allowing returns to be determined by real rental demand. Against the backdrop of continuous industrial population inflows, rental income is not a one-time realization, but a rolling, sustainable cash flow path. For investors, this visible, tangible, and sustainable rhythm of returns is itself a form of security.

◆ ◆ ◆ ◆

这不是一套适合所有人的房子

Not a Property for Everyone

◆ ◆ ◆ ◆

Atmoz Canvas Rayong 的 A/C 栋,并不是为所有购房者准备的。它更适合那些看重稳定现金流、希望资产“自己运转”,而不是频繁操心出租细节的人。

The A/C buildings of Atmoz Canvas Rayong are not designed for all buyers. They are more suitable for those who value stable cash flow and want their assets to “run themselves,” rather than constantly managing rental details.

如果你追求的是居住自由、随时自用,B 栋显然更合适;但如果你的目标是借助政策与产业红利,在海外配置一笔可控、可预期的租赁资产,那么 A/C 栋的包租与托管机制,正好帮你把风险和精力成本降到最低。很多投资机会的本质,不在于收益有多高,而在于能否长期站得住。

If you prioritize flexibility and personal use, Building B is clearly more suitable. But if your goal is to leverage policy and industrial dividends to allocate a controllable and predictable overseas rental asset, the guaranteed rent and management mechanism of Buildings A and C help minimize risk and time costs. Many investment opportunities are not defined by how high the returns are, but by whether they can stand the test of time.

在 EEC 持续推进、产业人口不断进入罗勇的背景下,这类被提前设计好现金流路径的资产,往往更容易穿越周期,慢慢体现价值。

With the continued advancement of the EEC and the steady inflow of industrial populations into Rayong, assets that have their cash flow paths designed in advance are often better positioned to endure cycles and gradually demonstrate long-term value.