2026年泰国工业地产逆势走强,但真正的机会,可能不在厂房里

在整体房地产市场承压的背景下,泰国工业地产却成了一个明显的“例外”。多家国际机构的研究显示,工业园区与仓储物流板块并没有随周期降温,反而在近几年持续扩张。无论是新增仓储租赁面积,还是工业园区土地交易规模,都保持在较高水平。尤其进入 2025 年后,工业园与仓储相关的数据表现,与住宅、商业等传统板块形成了清晰分化——当其他赛道放缓时,工业地产仍在往前走。

Against the backdrop of mounting pressure across the broader real estate market, Thailand’s industrial property sector has emerged as a clear “exception.” Research from multiple international institutions shows that industrial estates and logistics warehousing have not cooled with the economic cycle. On the contrary, they have continued to expand in recent years. Both newly leased warehouse space and industrial land transaction volumes have remained at relatively high levels. Especially since entering 2025, performance indicators related to industrial parks and logistics have clearly diverged from traditional sectors such as residential and commercial real estate. While other segments slow down, industrial property continues to move forward.

◆ ◆ ◆ ◆

机构数据给出答案

Data from Institutions Provide the Answer

◆ ◆ ◆ ◆

之所以说工业地产“逆势走强”,并不是情绪判断,而是被多份机构报告反复验证的结果。高力国际泰国(Colliers Thailand)在最新研究中指出,工业园区与仓储物流板块将在 2026 年继续保持活跃,这一趋势并非短期反弹,而是由消费结构变化长期推动。自 2020 年以来,电子商务与消费品行业持续扩张,直接拉动仓储需求增长,仅 2025 年一年,泰国新增仓储租赁面积就已突破 30 万平方米。

The characterization of industrial real estate as “defying the trend” is not a matter of sentiment, but a conclusion repeatedly validated by institutional reports. According to the latest research from Colliers Thailand, industrial estates and logistics warehousing are expected to remain active through 2026. This momentum is not a short-term rebound, but the result of long-term structural changes in consumption patterns. Since 2020, the continuous expansion of e-commerce and consumer goods industries has directly driven warehouse demand. In 2025 alone, newly leased warehouse space in Thailand exceeded 300,000 square meters.

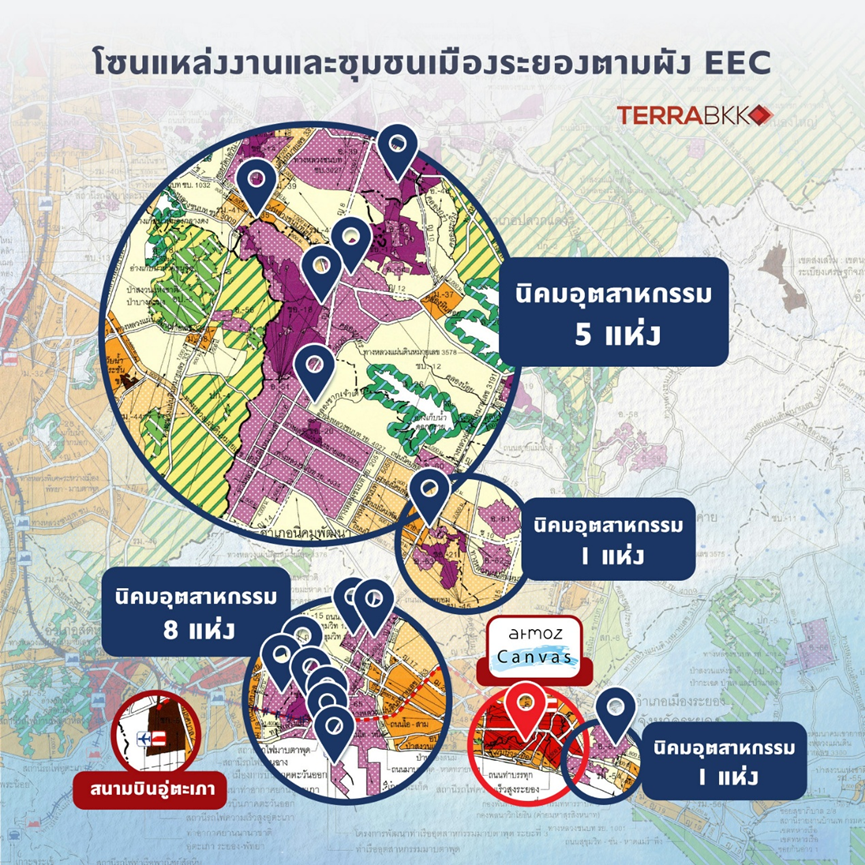

与此同时,工业园区的扩张速度同样显著。过去一年,泰国工业园区土地交易量累计超过 6,500 莱,其中大部分集中在 东部经济走廊(EEC) 区域,显示出外资企业在生产布局上的持续加码。这些数据共同指向一个事实:工业地产的增长,并非孤立事件,而是建立在真实需求之上。

At the same time, industrial estate expansion has been equally notable. Over the past year, total industrial land transactions surpassed 6,500 rai, with the majority concentrated in the Eastern Economic Corridor (EEC). This concentration reflects the sustained commitment of foreign enterprises to expanding their production footprints. Together, these data points underscore a key fact: the growth of industrial real estate is not an isolated phenomenon, but one firmly rooted in real demand.

◆ ◆ ◆ ◆

供应链正在重构

Supply Chains Are Being Reconfigured

◆ ◆ ◆ ◆

如果把时间线拉长,会发现泰国工业地产的走强,并不是单点事件,而是全球供应链调整的结果。过去几年,在国际政治环境、贸易政策和成本结构不断变化的背景下,越来越多企业开始重新审视产能布局,“去单一化、做备份”成为共识。相比只押注一个市场,分散生产基地、靠近终端消费市场,显然更安全。

Viewed over a longer time horizon, the strength of Thailand’s industrial real estate market is not a single-event outcome, but part of a broader global supply chain reconfiguration. In recent years, amid shifting geopolitical conditions, trade policies, and cost structures, companies have increasingly re-evaluated their production layouts. “De-risking and building backups” has become a widely shared consensus. Compared with concentrating production in a single market, diversifying manufacturing bases and moving closer to end consumers is clearly a safer strategy.

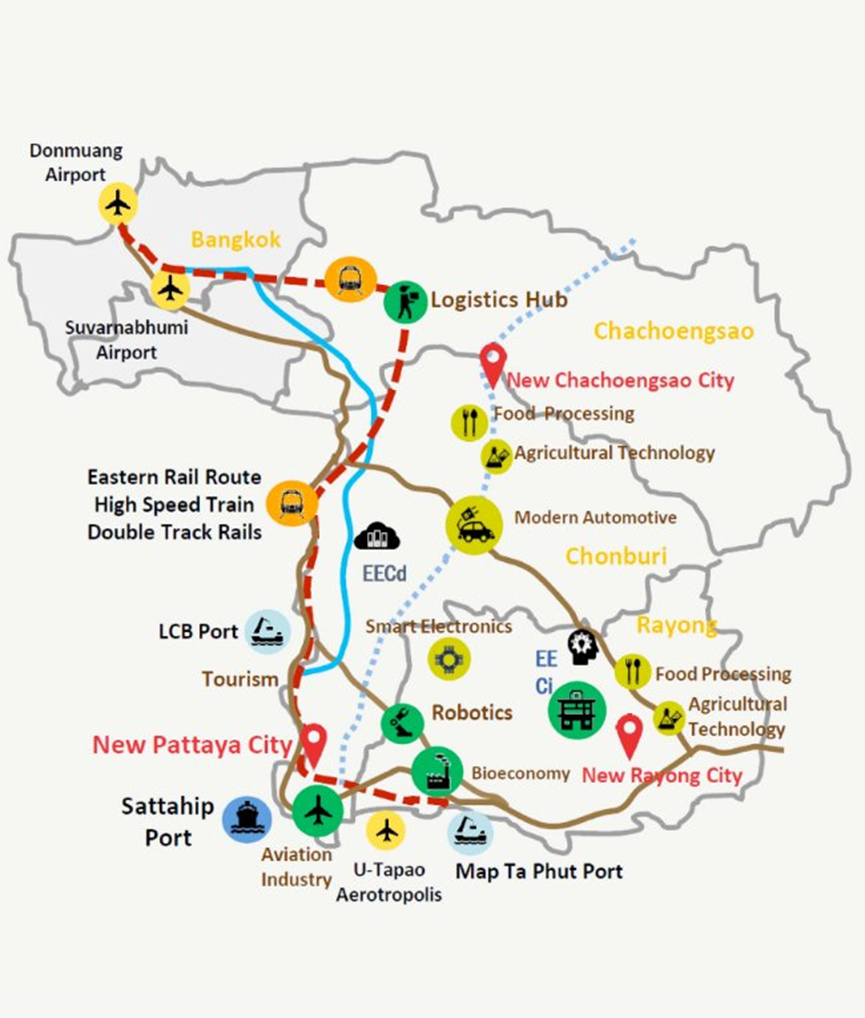

在这一轮调整中,泰国的优势逐渐凸显:区位上连接东盟核心市场,基础设施成熟,制造业体系完整,同时具备相对稳定的营商环境。尤其是 EEC 东部经济走廊,在税收优惠、产业规划和交通物流等方面形成了明显叠加效应,成为外资企业落地东南亚的重要承载区。也正是在这样的背景下,工业园区、仓储物流和相关土地需求,被持续推高。

In this adjustment cycle, Thailand’s advantages have gradually come into sharper focus. Strategically located at the heart of ASEAN, supported by mature infrastructure and a comprehensive manufacturing ecosystem, Thailand also offers a relatively stable business environment. The EEC, in particular, has created a powerful cumulative effect through tax incentives, industrial planning, and transportation and logistics infrastructure, making it one of the most important landing zones for foreign investment in Southeast Asia. Against this backdrop, demand for industrial estates, logistics facilities, and related land has continued to rise.

◆ ◆ ◆ ◆

工厂之后住哪里

After the Factories, Where Do People Live?

◆ ◆ ◆ ◆

当工业园区不断扩张、厂房一座接一座落地时,一个现实问题开始被反复提及,却常常被低估:这些产业背后的人,住在哪里?

As industrial parks continue to expand and factories are built one after another, a practical question is increasingly raised—yet often underestimated: where do the people behind these industries live?

制造业投资带来的,并不只是生产线,还有大量随之而来的管理人员、工程师、技术骨干和外派团队。这些人并非短期流动,而是以一年、两年甚至更长周期驻扎在当地。他们对居住的要求,也早已不是“离工厂近就行”,而是能否支撑长期生活。

Manufacturing investment brings not only production lines, but also large numbers of managers, engineers, technical specialists, and expatriate teams. These individuals are not short-term visitors; many are stationed locally for one, two, or even more years. Their housing needs have long surpassed the simple requirement of “being close to the factory,” and instead revolve around whether the living environment can support a long-term lifestyle.

正是在这一层需求上,工业地产的增长开始向外延伸——从“厂房和土地”,延伸到与产业高度绑定的居住与生活空间。而这部分需求,往往不会立刻反映在宏观数据中,却决定了一个区域能否真正承接住产业红利。

It is precisely at this level of demand that industrial real estate growth begins to extend outward—from factories and land to residential and lifestyle spaces closely tied to industrial activity. This demand rarely shows up immediately in macro-level data, yet it ultimately determines whether a region can truly absorb and sustain industrial dividends.

◆ ◆ ◆ ◆

罗勇角色正在变化

Rayong’s Role Is Changing

◆ ◆ ◆ ◆

在整个 EEC 区域中,罗勇的角色正在发生微妙变化。过去,它更多被视为工业生产的前线城市;而现在,随着产业密度不断提高,罗勇开始被要求承担另一个功能——承接长期驻扎的人口生活。

Within the EEC region, Rayong’s role is undergoing a subtle but significant shift. In the past, it was primarily viewed as a frontline industrial production city. Today, as industrial density continues to rise, Rayong is increasingly expected to take on another function: accommodating long-term resident populations.

大量中资与外资制造企业在这里设厂,使得外派管理层、工程师和技术人员不再是短暂停留,而是持续存在。这类人群对居住的要求,与传统产业工人完全不同:通勤效率只是基础,更重要的是城市配套是否成熟、生活是否方便、家庭是否能安顿下来。也正是在这样的需求变化下,罗勇市中心的居住价值开始被重新审视——不再只是“离工厂近”,而是“能不能长期生活”。

The presence of large numbers of Chinese and multinational manufacturing enterprises has transformed expatriate managers, engineers, and technical personnel from transient visitors into a stable, ongoing population. Their housing preferences differ fundamentally from those of traditional industrial workers. While commuting efficiency remains important, what matters more is whether urban amenities are mature, daily life is convenient, and families can settle comfortably. As a result, the residential value of Rayong’s city center is being reassessed—not merely as “close to factories,” but as a place where people can truly live long term.

◆ ◆ ◆ ◆

被反复选择的住宅

Residences That Are Chosen Again and Again

◆ ◆ ◆ ◆

当产业人口开始从“短期驻扎”转向“长期生活”,被反复选择的住宅,往往具备一些共性:通勤距离可控、城市配套成熟、居住品质不将就。在罗勇,这类项目并不多,而 Atmoz Canvas Rayong 正好踩在这个需求交汇点上。

As industrial populations shift from short-term stays to long-term living, the residential projects that are repeatedly chosen tend to share common traits: manageable commuting distances, mature urban amenities, and uncompromised living quality. In Rayong, such projects are relatively rare, and Atmoz Canvas Rayong happens to sit precisely at this intersection of demand.

项目位于罗勇市中心主干道,紧邻 Central Rayong 尚泰百货,生活所需几乎都在步行范围内;与此同时,从这里出发,15 分钟左右即可覆盖 Map Ta Phut、IRPC、Hemaraj 等多个核心工业园区。对外派管理层和工程师来说,这种“上班不远、下班回到城市生活圈”的状态,恰恰是能够长期住下来的前提。也正因为如此,这类住宅更像是产业发展的生活基础设施,而不是单纯的居住产品。

Located on a main arterial road in Rayong’s city center, adjacent to Central Rayong shopping mall, the project places daily necessities within walking distance. At the same time, it offers approximately 15-minute access to major industrial zones such as Map Ta Phut, IRPC, and Hemaraj. For expatriate managers and engineers, this balance—short commutes combined with access to a full urban lifestyle—is a prerequisite for long-term residence. For this reason, such housing functions less as a conventional residential product and more as essential living infrastructure supporting industrial development.

◆ ◆ ◆ ◆

生活决定租赁

Lifestyle Determines Leasing Outcomes

◆ ◆ ◆ ◆

真正决定一套房子能否长期被选择的,并不是概念,而是生活本身是否成立。对长期驻扎在罗勇的产业人群来说,下班之后有没有地方运动、放松、社交,周末能不能正常生活,直接影响他们是否愿意继续住下去。Atmoz Canvas Rayong 的公共空间配置,本质上就是为这种生活节奏服务的:健身房、泳池、会所、共享办公空间,让居住不再只是“回去睡觉”。当一个项目能够承载真实的日常,它在租赁市场上的表现,往往只是顺带发生的结果——住得舒服的人,会住得久,也更容易形成稳定的长期需求。

What ultimately determines whether a residence is chosen over the long term is not conceptual positioning, but whether daily life truly works. For industrial professionals stationed in Rayong, access to fitness, relaxation, and social interaction after work—and the ability to enjoy normal weekends—directly influences their willingness to stay. The shared spaces at Atmoz Canvas Rayong are fundamentally designed to serve this lifestyle rhythm: gyms, swimming pools, clubhouses, and co-working areas ensure that living is more than simply returning home to sleep. When a project can support real everyday life, its performance in the rental market often follows naturally. People who live comfortably tend to stay longer, creating stable and sustained demand.

◆ ◆ ◆ ◆

被低估的后半程

The Underestimated Second Half

◆ ◆ ◆ ◆

回头再看工业地产的这轮“逆势走强”,它真正释放的信号,或许并不只停留在厂房和土地本身。工业园区解决的是生产效率,而与之同步增长的,是一整套围绕产业人口展开的生活需求。当制造业开始以更长期、更稳定的方式扎根,一个区域是否具备承接这些人的能力,就变得同样重要。

Looking back at this wave of “counter-cyclical growth” in industrial real estate, the most important signal it sends may not lie solely in factories or land. Industrial parks address production efficiency, but growing alongside them is a comprehensive set of lifestyle needs centered on industrial populations. As manufacturing takes root in a more long-term and stable manner, a region’s ability to accommodate these people becomes just as critical.

也正是在这个意义上,像罗勇这样的 EEC 核心城市,以及 Atmoz Canvas Rayong 这类能够同时满足通勤效率与城市生活的住宅项目,开始显现出它们的价值——它们并不是工业地产的替代品,而是工业地产增长之后,自然出现的下一环。当市场目光还集中在“厂房在哪里”时,真正具备延展性的机会,往往已经悄悄转向了人住在哪里、能不能长期住下去。

In this sense, EEC core cities such as Rayong—and residential projects like Atmoz Canvas Rayong that combine commuting efficiency with urban living—are beginning to reveal their true value. They are not substitutes for industrial real estate, but rather the natural next link in the chain that emerges after industrial growth. When market attention remains focused on “where the factories are,” the more extensible opportunities have often already shifted quietly toward where people live—and whether they can live there for the long term.