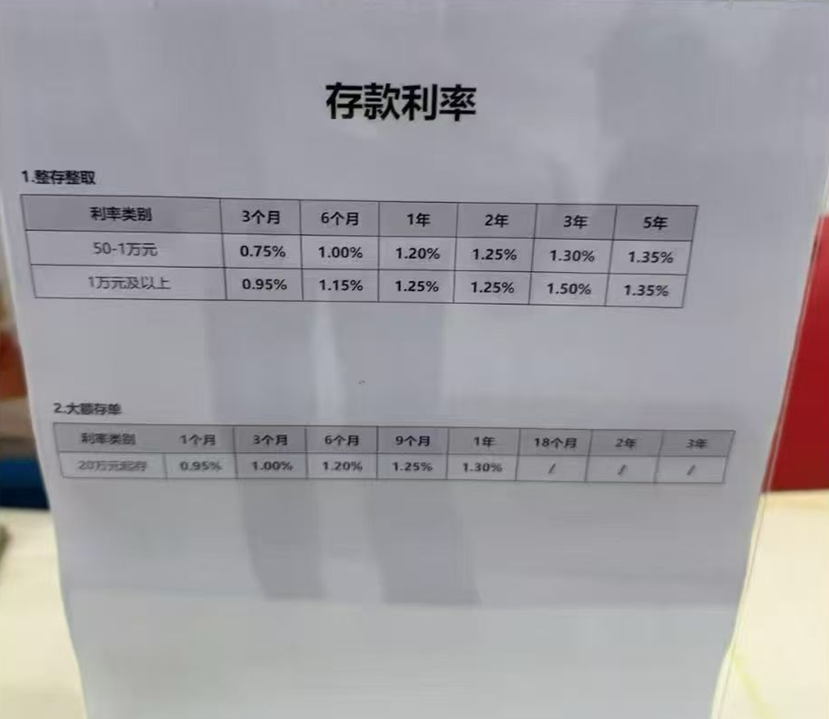

当大额存单进入“0字头”,钱到底该不该继续躺着?

今年以来,不少银行的短期大额存单利率已经悄然进入“0字头”,和普通定存之间的差距越来越小。表面看,这只是一次利率调整,但对习惯用存款来管理资金的投资客户来说,这背后其实释放了一个很明确的信号——钱依然安全,但“躺着”的回报,正在快速缩水。

Since the beginning of this year, interest rates on short-term large-amount certificates of deposit at many banks have quietly fallen into the “zero-point-something” range, narrowing the gap between them and ordinary fixed deposits. On the surface, this appears to be nothing more than another interest rate adjustment. But for investors who are accustomed to managing their funds primarily through deposits, it sends a very clear signal: money remains safe, but the return from simply letting it “lie still” is shrinking rapidly.

利率下行并不意味着风险上升,恰恰相反,它反映的是一个正在形成的常态:低利率,可能会持续很久。在这样的环境下,资金最大的变化不是“会不会亏”,而是还能不能有效地产生价值。

A declining interest rate environment does not imply rising risk. On the contrary, it reflects a new normal that is gradually taking shape—low interest rates may persist for a long time. In such an environment, the biggest change for capital is not whether it will lose money, but whether it can still generate value effectively.

◆ ◆ ◆ ◆

钱还在,但没工作

The Money Is Still There, but It’s Not Working

◆ ◆ ◆ ◆

很多稳健型投资客户都会有一种判断:只要本金不动,钱就还在。但在低利率周期里,这个判断正在悄悄失效。存款更像是被妥善保管,却没有真正参与任何经济活动。时间在流逝,生活成本在变化,但资金本身并没有“工作”。

Many conservative investors tend to believe that as long as the principal remains untouched, their money is still intact. However, in a low-interest-rate cycle, this assumption is quietly losing its validity. Deposits are more like funds being carefully stored rather than actively participating in any real economic activity. Time passes, living costs evolve, yet the capital itself is not “working.”

当利息越来越薄,这种被动状态,本身就成了一种看不见的成本。这也是为什么,越来越多资金开始重新思考一个问题:钱到底是靠“等利息”,还是靠“被使用”来获得回报。

As interest income becomes thinner and thinner, this passive state turns into an invisible cost. This is why more and more funds are being forced to reconsider a fundamental question: should money rely on “waiting for interest,” or on “being put to use,” to generate returns?

◆ ◆ ◆ ◆

差距不在收益率

The Real Gap Is Not in the Yield

◆ ◆ ◆ ◆

在低利率环境中,真正拉开差距的,已经不再是收益率数字,而是钱是通过什么方式赚钱。存款的逻辑很简单,银行按期支付利息,与真实需求并没有直接关系;而现金流型资产则完全不同,它的前提是有人在长期使用,并且愿意持续付费。

In a low-interest-rate environment, what truly widens the gap is no longer the numerical yield itself, but the way money earns returns. The logic of deposits is straightforward: banks pay interest on schedule, with little direct connection to real demand. Cash-flow-oriented assets, however, operate on an entirely different premise—they depend on long-term users who are willing to pay continuously.

一旦这种关系成立,回报就不再依赖市场情绪,而是来自重复发生的现实需求。所以,判断一项资产稳不稳,关键不在“涨不涨”,而在于:是谁在持续为它付钱。

Once such a relationship is established, returns are no longer driven by market sentiment, but by recurring, real-world demand. Therefore, when assessing the stability of an asset, the key question is not whether it will “rise or fall,” but rather: who is consistently paying for it?

◆ ◆ ◆ ◆

现金流来自哪里

Where Does Cash Flow Come From?

◆ ◆ ◆ ◆

真正付钱的,从来不是市场,而是具体的人。当一项资产背后,对应的是长期驻扎、必须生活的人群,现金流就不再是偶然,而是一种持续发生的行为。

Ultimately, it is never the market that pays, but real people. When an asset is backed by a population that must live and stay long term, cash flow ceases to be accidental and becomes a recurring behavior.

这类人群不会因为短期行情改变居住选择,他们的租金支出,本质上是一种生活成本,而不是投资行为。也正是在这一层逻辑上,产业与人口的关系,开始变得尤为重要。

Such groups do not change their living arrangements based on short-term market fluctuations. Their rental payments are essentially a living expense, not an investment decision. It is at this level that the relationship between industry and population becomes particularly critical.

◆ ◆ ◆ ◆

产业带来人口

Industry Brings Population

◆ ◆ ◆ ◆

在东部经济走廊(EEC)持续推进的背景下,罗勇这样的工业核心城市,最先发生变化的并不是房价,而是人口结构。大量制造企业及其上下游配套落地,带来的并不仅是工厂本身,还有外派管理层、工程师和技术人员。

Against the backdrop of the continued advancement of the Eastern Economic Corridor (EEC), industrial core cities such as Rayong have not seen the most immediate changes in housing prices, but rather in population structure. The establishment of large manufacturing enterprises and their upstream and downstream supply chains brings not only factories, but also expatriate managers, engineers, and technical professionals.

这类人群往往以“年”为单位长期驻扎,对居住的要求并不复杂,但非常明确:通勤可控、生活便利、能够长期住下去。这种需求不是预测出来的,而是已经真实存在,并且会随着产业持续发展而长期存在。

These groups typically stay on a long-term basis, measured in years. Their housing requirements are not complicated, but they are very clear: manageable commuting times, convenient daily life, and the ability to live comfortably over the long term. This demand is not speculative—it already exists and will continue to exist as industrial development progresses.

◆ ◆ ◆ ◆

项目如何对上需求

How Projects Align with Real Demand

◆ ◆ ◆ ◆

也正因为如此,市场上真正能承接这类需求的项目并不多。以 Atmoz Canvas Rayong 为例,它并不是被包装成“投资概念”,而是从一开始就对准了这群长期居住人群。

For this reason, there are actually very few projects in the market that can genuinely accommodate such demand. Take Atmoz Canvas Rayong as an example. It is not packaged as an “investment concept,” but from the outset has been designed specifically for long-term residents.

项目位于罗勇市中心成熟生活区,同时约15分钟通勤即可覆盖多个核心工业园,本质上解决的是“住得久”的问题,而不是“能不能租一次”的问题。当居住逻辑成立,租赁才具备持续性。

Located in a mature residential area in downtown Rayong, with approximately a 15-minute commute covering multiple core industrial parks, the project fundamentally addresses the question of “living long-term,” rather than “whether it can be rented once.” When the logic of living holds, rental sustainability naturally follows.

◆ ◆ ◆ ◆

区位决定住多久

Location Determines Length of Stay

◆ ◆ ◆ ◆

很多人以为,靠近工业园就意味着好出租,但真正跑过市场就会发现,决定租得久不久的,从来不是“最近”,而是“顺不顺”。

Many people assume that proximity to industrial parks automatically ensures good rental performance. However, real market experience shows that what determines how long tenants stay is not “how close,” but “how smooth and convenient.”

对外派管理层和技术人员来说,上班不折腾、下班能回到成熟的城市生活圈,是能否住上一两年的关键。也正因为这种区位与生活半径的匹配,项目的租赁逻辑才更偏向长期,而不是频繁更换租客的短期博弈。

For expatriate managers and technical professionals, a hassle-free commute combined with access to a mature urban lifestyle after work is the key factor in deciding whether they will stay for one or two years. It is precisely this alignment between location and daily life radius that shifts a project’s rental logic toward long-term stability, rather than short-term tenant turnover.

◆ ◆ ◆ ◆

包租解决不确定

Guaranteed Rental Reduces Uncertainty

◆ ◆ ◆ ◆

对稳健型现金流投资客户而言,最大的风险往往不在长期,而在前期:交付后能不能马上出租、租给谁、租金是否合理。

For conservative cash-flow investors, the greatest risk often lies not in the long term, but in the initial stage: whether the property can be rented immediately after handover, who the tenants will be, and whether the rental price is reasonable.

这里提到的 4%包租 + 3年统一托管,真正的价值并不在于数字本身,而在于把最容易出问题的阶段提前解决掉。首年包租解决的是“有没有现金流”的不确定,后续托管解决的是海外资产运营中最容易消耗精力的部分。

The real value of a 4% guaranteed rental return plus three years of unified management lies not in the numbers themselves, but in resolving the most problematic phase in advance. The first-year guaranteed rental addresses the uncertainty of “whether cash flow exists,” while subsequent unified management eliminates the operational burdens that most commonly drain energy in overseas asset ownership.

◆ ◆ ◆ ◆

回到最初选择

Returning to the Original Question

◆ ◆ ◆ ◆

回到最初的问题:当大额存单进入“0字头”,钱到底该不该继续躺着?躺着当然也是一种选择,但它已经不再是没有代价的选择。

This brings us back to the original question: when large-amount certificates of deposit enter the “zero-point-something” era, should money still just lie there? Letting it lie still is certainly a choice—but it is no longer a cost-free one.

在低利率成为常态的背景下,时间本身正在变成成本。对稳健型投资客户而言,真正重要的并不是“要不要更激进”,而是是否应该让一部分资金,进入一个已经被真实需求反复验证、并且现金流路径清晰的状态。当这些条件成立,资产本身反而不需要太多情绪参与。

As low interest rates become the norm, time itself is turning into a cost. For conservative investors, what truly matters is not whether they should become more aggressive, but whether a portion of their capital should be placed into assets that have been repeatedly validated by real demand and have a clear, transparent cash-flow path. When these conditions are met, the asset itself requires very little emotional involvement.