Could you provide an example? I am interested in a comprehensive cost analysis for purchasing an apartment in Thailand.

买房租房,海外置业得看内行。

海外置业不比国内,国情不同政策也不一样。加之语言障碍,即使有想法投资,苦于没有靠谱的置业顾问也是有心无力,最后也就不了了之。

今天YOUDEE将以目前曼谷高性价比区域Rama 9的Aspire HuaiKhwang 项目为例子,为大家讲解一下在泰国买房究竟涉及到哪些费用。

Acquiring a property for rental purposes requires expertise, especially when dealing with overseas real estate.

International properties differ from domestic ones due to varying national conditions and policies. Additionally, the language barrier can hinder investment ideas, making it difficult to find a reliable property consultant.

Today YOUDEE will use the Aspire HuaiKhwang Project in Rama 9 as an example to illustrate the process of purchasing a home in Thailand.

Aspire HuaiKhwang by AP

点击下方图片了解更多项目信息↓↓↓

01

房价

看好项目选中心仪的房间单位之后,跟销售人员谈好的成交价格,这个就是房价。

以Aspire HuaiKhwang为例,目前27㎡的一房最低总价为384.9万泰铢起,目前还能享受早鸟优惠30万泰铢,成交房价就是354.9万泰铢。

After the project is selected, the desired room unit is negotiated with the sales staff. This is the price of the house.

Take Aspire HuaiKhwang as an example, the minimum total price of a room of 27 square meters is 3.849 million baht starting, can also enjoy early bird discount of 300,000 baht, the transaction price is 3.549 million baht.

02

过户费

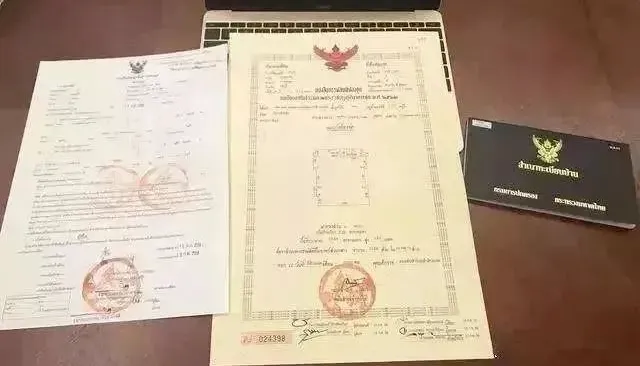

在交房后,需要到当地土地厅完成产权转让,将原开发商持有的房间单位过户给购买人。过户费税率为2%,一般为开发商跟购买人各承担一半,计算的基础是政府的评估价。

(注:泰国过户土地房产等,计算过户税费的时候,计算的基础数值往往有两个,一个是买卖双方对土地厅申报的买卖价格,一个是土地厅部门自己的评估价格,政府的评估价往往比实际成交价要低一些,有的甚至低一半以上,因为政府不是每年都更新评估价,而市场的价格却是每年都在涨。)

举例:354.9万购买的Aspire HuaiKhwang某单位,政府评估价为350万泰铢,即所需缴纳过户费为7万泰铢,也就是个人只需要付3.5万泰铢即可。

有时候开发商会做促销活动,直接免除这个费用。

After the handover, it is necessary to complete the transfer of property rights to the local land Department and transfer the room unit held by the original developer to the purchaser. The transfer fee is taxed at a rate of 2%, which is generally borne by the developer and the buyer equally, and is calculated on the basis of a government appraisal.

(Note: In Thailand, when calculating the transfer tax, there are often two basic values: one is the sale price declared by the buyer and seller to the land hall, and the other is the evaluation price of the land hall department itself. The evaluation and valuation of the government is often lower than the actual transaction price, and some are even more than half lower, because the government does not update the evaluation and valuation every year. And the market price is going up every year.)

For example: 3,549,000 purchased Aspire HuaiKhwang a unit, the government assessed the value of 3.5 million baht, that is, required to pay the transfer fee of 70,000 baht, that is, individuals only need to pay 35,000 baht.

Sometimes developers offer promotions that waive the fee.

03

印花税或特种商业税

印花税的税率是0.5%,特种商业税是3.3%。两者只要缴纳其中之一即可,计算的基础是取政府评估价或者申报价两者之间更高的那个数值,分两种情况。

第一种情况:持有房产超过五年以上,再卖出的时候就只需要缴纳0.5%的印花税,而反之五年内卖出则需要缴纳3.3%的特种商业税;

第二种情况:业主名字放进房产本(泰国人用的是蓝本,外国人要单独申请黄本)超过一年以上,再卖出的时候就只需要缴纳0.5%的印花税,而反之则需要缴纳3.3%的特种商业税;

注:如果卖家为公司名义持有房产,那么无论如何都需要缴纳3.3%的特种商业税。

354.9万泰铢的Aspire HuaiKhwang某单位,需要支付的印花税就是17745泰铢。

The stamp duty rate is 0.5% and the special business tax is 3.3%. Only one of the two can be paid, and the calculation is based on taking the higher value between the government appraisal and the declared price, divided into two cases.

The first situation: hold the property for more than five years, and then sell it only need to pay 0.5% stamp duty, while sell it within five years need to pay 3.3% special business tax;

The second situation: the owner's name into the real estate book (Thais use the blue book, foreigners have to apply for the Yellow Book separately) more than a year, and then sell only need to pay 0.5% stamp duty, and on the contrary need to pay 3.3% special business tax;

Note: If the seller holds the property in the name of the company, then there is a special business tax of 3.3% in any case. 3.549 million baht Aspire HuaiKhwang a unit, need to pay the stamp duty is 17,745 baht.

04

收入税

这个税率是根据房子新旧程度计算折旧,并且根据阶梯税率的计算模式,相对比较复杂,大致在1-3%之间。

一般来讲都是开发商承担,但是实际交易当中,也有买卖双方一人一半的情况。

This tax rate is calculated according to the old and new degree of depreciation of the house, and according to the calculation model of the ladder tax rate, relatively complex, roughly between 1-3%.

Generally speaking, the developer is responsible, but in the actual transaction, there are also half of the buyer and seller.

05

水电表安装费

项目不一样价格也不同,只需要缴纳一次即可,一般为3000-5000泰铢左右。

The project is not the same price is different, only need to pay once, generally about 3000-5000 baht.

06

物业费

住宅的游泳池,健身房,包括停车场都是免费使用,物业对这些公共设施的维护开销来源就是物业费。一般交房时需要预付一年的物业费。

曼谷公寓一般物业费标准是:40-60泰铢/㎡/月,27㎡的Aspire HuaiKhwang按照50泰铢标准收取,一年物业费为:16200泰铢。

The residential swimming pool, gym, including parking are free to use, and the maintenance cost of these public facilities comes from the property fee.

Generally, one year's property fee is required in advance when the room is handed over.

Bangkok apartment general property fee standard is: 40-60 baht /㎡/ month, 27㎡ Aspire HuaiKhwang in accordance with 50 baht standard charge, one year property fee is: 16200 baht.

07

公共维修基金

曼谷的公寓公共维修基金标准是:400-900泰铢/㎡,维修基金一次性缴纳,以后不需要再缴纳。

Aspire HuaiKhwang 27㎡的单位按照一般档标准要支付的公共维修基金为13500泰铢。

Bangkok apartment public maintenance fund standard is: 400-900 baht/㎡.

The maintenance fund is paid in one lump sum and does not need to be paid again later.

Aspire HuaiKhwang 27 ㎡ units in accordance with the general file standard to pay for the public maintenance fund of 13500 baht.

08

打个总结

以Aspire HuaiKhwang为例子,泰国公寓的拥有成本约为363.5万起,合人民币约74万,即可在国际大都市曼谷新兴的中央商务区 Rama 9(点击这里查看相关内容)拥有一套永久产权、度假投资两相宜的公寓。相较于国内的内耗,鸡蛋永远不要放在一个篮子里,走向国际才是稳妥的投资。

Taking Aspire HuaiKhwang as an example, the cost of owning an apartment in Thailand starts from approximately 3.635 million baht, equivalent to around RMB 740,000, for acquiring a freehold vacation investment property in Rama 9, a rapidly developing central business district in the cosmopolitan city of Bangkok.

In comparison with domestic market volatility, diversifying investments internationally is a prudent strategy.